Japan's industrial production to offer cues on BOJ stimulus

Oct 28, 2015 11:22 am UTC| Insights & Views Central Banks Economy

Japans industrial production data is due for release on Oct 29, Thursday, a day before BOJ policy meeting, at which the c.bank mulls further stimulus. The production data is of great significance as a gauge on whether the...

Markets price-in 90% probability of RBA rate cut next week

Oct 28, 2015 10:43 am UTC| Insights & Views Central Banks

Todays weaker than expected inflation numbers has led to skyrocketing expectation of a rate cut by Reserve Bank of Australia (RBA) next week, when the bank is set to meet to announce decision on November 3rd. In...

Riksbank fires another round of QE bullet, Krona still strong

Oct 28, 2015 09:55 am UTC| Insights & Views Central Banks

Swedens Riksbankhas kept the interest rates steady, while firing another round of quantitative easing. Interest rate was kept at -0.35%, while increasing its asset purchase program by SEK 65 billion. Citing...

Riksbank likely to demonstrate readiness

Oct 28, 2015 08:52 am UTC| Commentary Central Banks

Things were going quite well for the Riksbank. It seems to have convinced the markets that it will prevent an (excessive) appreciation of the SEK, which is why EUR-SEK has not traded notably below 9.20 since March....

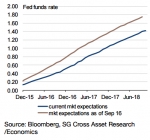

Does FOMC want to reaffirm a December liftoff?

Oct 28, 2015 06:16 am UTC| Commentary Central Banks

The FOMC would keep the economic assessment broadly unchanged and avoid references to the recent soft patch in the data. It could remove the reference to monitoring developments abroad following the assessment that the...

RBA likely to hold bank rates at current level

Oct 28, 2015 06:16 am UTC| Commentary Central Banks

The Reserve Bank board of Reserve Bank of Australia meets next week on November 3. The board is expected to keep rates on hold, states Westpac. The surprise drop in the inflation measure is not unique and, in the past, the...

If the FOMC wants to move away from a December liftoff?

Oct 28, 2015 06:12 am UTC| Commentary Central Banks

First, the Fed could insert a phrase that the pace of job gains moderated. The Committee used a similar phrase in April to signal that a June liftoff was becoming less likely. Second, it would probably keep the sentence...

- Market Data