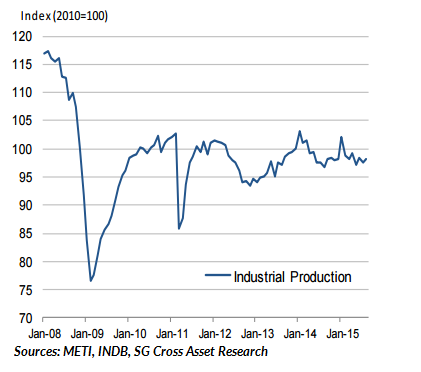

Japan's industrial production data is due for release on Oct 29, Thursday, a day before BOJ policy meeting, at which the c.bank mulls further stimulus. The production data is of great significance as a gauge on whether the BOJ will ease further. Analysts expect industrial production to show a 0.6 percent decline from August, when it dropped a revised 1.2 percent. A gain of 5 percent in September would be needed for third-quarter output to reach zero percent, according to the trade ministry.

"The September industrial production to fall by 0.5% mom, after a decline of 1.2% mom (-0.4% yoy) in August", notes Societe Generale.

Industrial production is more closely correlated with export volumes and the data in September suggest a downside risk to production. In the October Monthly Economic Report by Cabinet Office, the government's assessment on exports and production were both explained as showing "a weak tone recently". Weaker data would fuel concerns that Japan's economy contracted last quarter and entered the second recession since Prime Minister Shinzo Abe took office.

"There will be no surprise if we see a negative number for July-September GDP," Hiroaki Muto, chief economist at Tokai Tokyo Research Center Co. in Tokyo, said after the retail sales report was released.

When the BoJ implemented additional QQE measures in October 2014, production were showing negative growth for two consecutive quarters. If September production is as weak as most analysts anticipate, it will be the third consecutive month of negative growth, confirming its weakness as a trend. Once the September production figure confirms that the production trend is weak, the BoJ is expected to implement additional QQE measures at the 30 October meeting.

Although instability still prevails in emerging economies and the global market, there is a significant possibility that production will ultimately recover. Recovery, however, depends on how strongly exports pick up on the back of a US economic recovery, and also on the extent to which the Chinese economy will avoid an economic downturn. As long as the government and the BoJ keep the policy stance firm, movement towards a complete exit from deflation is intact.

USD/JPY range-bound on the day as nervousness creeps into markets ahead of the much awaited Fed policy decision. Downside remains cushioned as the yen remains weighed down by the dismal retail sales figures. At 1100 GMT Yen was trading at 120.31 against the Greenback, while against the Euro it was at 133.10.

Japan's industrial production to offer cues on BOJ stimulus

Wednesday, October 28, 2015 11:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient