FxWirePro: The Day Ahead- 3rd March 2017

Mar 03, 2017 05:04 am UTC| Commentary Economy Central Banks

Lots of economic dockets and events scheduled for today and some with high volatility risks associated. Data released so far: New Zealand: ANZ commodity price index rose 2 percent in February. Japan: Markit...

Bank Negara Malaysia maintains interest rate unchanged at 3 pct

Mar 02, 2017 16:33 pm UTC| Commentary Central Banks

Bank Negara Malaysia (BNM) stood pat at policy meeting on Thursday, holding the Overnight Policy Rate (OPR) unchanged at 3.00 percent. BNM said that economic conditions have evolved in line with their expectations. In...

Mar 02, 2017 15:28 pm UTC| Commentary Economy Central Banks

Poland PMI in February dropped slightly from 54.8 in January to 54.2 points, but still remains close 22-month highs, which point to strong business conditions in the Polish manufacturing. Business conditions have improved...

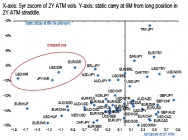

FxWirePro: Long-tenured low vols carry in USD/INR and USD/IDR

Mar 02, 2017 12:59 pm UTC| Central Banks Commentary

USDINR and USDIDR long-dated FX vols offer exceptionally low vol to carry. The dramatic sell-off in 2Y USD rates since the election of Trump registers as the sharpest since the ill-fated recovery sell-off of H1 2008....

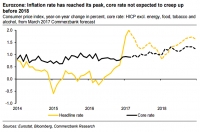

Eurozone inflation hits 2 pct in Feb, likely to intensify debate surrounding ECB's QE exit

Mar 02, 2017 12:48 pm UTC| Insights & Views Economy Central Banks

Eurozone inflation has risen above the European Central Banks (ECB) target rate for the first time in four years, data from statistical agency Eurostat showed on Thursday. Inflation in the 19-nation bloc hit 2 percent in...

USD Libor reaches 8-year high on hawkish FOMC

Mar 02, 2017 11:35 am UTC| Commentary Central Banks

The cost of funding in US dollar reached the highest level since April 2009 as the interest rate reached just below 1.1 percent yesterday. The cost for banks to borrow in US dollar jumped by the most yesterday since...

FxWirePro: Driving forces of CHF’s bullish and bearish scenarios

Mar 02, 2017 11:26 am UTC| Central Banks Insights & Views

EURCHF is so far tracking our forecast which assumes a softening in the SNBs intervention regime and a resultant orderly decline of around one cent per quarter in the cross to 1.03 by year-end. The SNB is certainly not...

- Market Data