Mar 15, 2017 09:28 am UTC| Commentary Economy Central Banks

USD/TRY is expected to witness further upside this year if the Central Bank of Turkey (CBT) does not simplify its policy and tighten its main policy rate and only tries to muddle through using daily liquidity management...

Global Reflation Series: Inflation at multi-year high from Spain to Poland

Mar 15, 2017 08:32 am UTC| Commentary Central Banks

Latest data released yesterday show that the upward march of inflation that continued early last year is still gathering pace in Europe. Spain released its consumer price inflation report yesterday and it showed that...

BoK likely to remain on hold in near-term on concerns over rising household debt, says Fitch Ratings

Mar 15, 2017 08:17 am UTC| Commentary Central Banks Economy

The Bank of Korea (BoK) is expected to remain on hold in the near-term, over rising concerns over the countrys household debt problem. The current loose monetary policy is further, expected to help cushion the headwinds to...

Markets near certainty of FOMC rate hike in March

Mar 15, 2017 07:40 am UTC| Commentary Central Banks

A rate hike from the US Federal Reserves Federal Open Market Committee (FOMC) today is almost a certainty. The policymakers would conclude their two days of meeting today and announce the decision at 18:00 GMT, followed by...

Draghi says innovative technology could boost productivity in eurozone

Mar 14, 2017 13:37 pm UTC| Commentary Economy Central Banks

Speaking at a conference in Frankfurt, the European Central Bank (ECB) president Mario Draghi said on Monday that Europe could still see sizeable gains in productivity and that there are several ways to boost productivity...

FxWirePro: Damocles sword hanging over Mexican peso, FEC offers hedging mechanism

Mar 14, 2017 13:10 pm UTC| Central Banks Insights & Views

The recent US rhetoric has eased some NAFTA anxiety. Comments from US Treasury Secretary Mnuchin and Commence Secretary Ross have eased some of the anxiety that had built around the NAFTA renegotiation, a Damocles sword...

FxWirePro: Cable still seems fragile - Mounting hedging sentiments move in sync with driving forces

Mar 14, 2017 12:52 pm UTC| Central Banks Research & Analysis

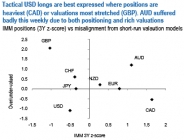

Cable is the most over-valued G10 currency versus the dollar (refer above chart). Indeed, cable is more expensive versus 2Y rate spreads than at any point in the last five years. Fair-value currently languishes at 1.15,...

- Market Data