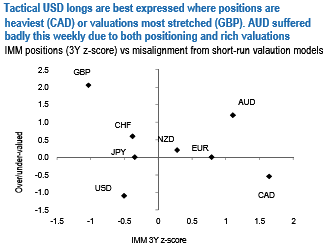

Cable is the most over-valued G10 currency versus the dollar (refer above chart). Indeed, cable is more expensive versus 2Y rate spreads than at any point in the last five years. Fair-value currently languishes at 1.15, more than two sigma below the spot rate (refer above chart). GBP is consequently one of the most attractive currencies to sell for an extension of the dollar’s interest rate rally.

There is also the strong domestic case to re-sell GBP insofar as:

1) The economy is now more clearly slowing in response to an inflation drag on consumption and underlying business caution due to Brexit. Growth in Q1’17 is expected to be only half the 2.9% recorded in Q4’16. High hopes for BoE rate hikes this year have been crushed.

2) The government is on course to trigger Article 50 by the middle of the month despite a setback in the House of Lords for its enabling legislation Q1 over Article 50. Investor confidence is vulnerable as it should become apparent.

All these fundamental driving forces of GBPUSD are factored in OTC FX markets.

The negative delta risk reversal numbers are bidding for downside risks, while IV slews are also substantiating this stance as the hedgers' interests are stretched towards OTM put strikes.

While risk reversals of 6m tenors also indicate the high degree of bearish risks, this would imply that the puts are relatively costlier than the call options, while 6m IV skews are the evidence of the hedgers’ interests of OTM put bids.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields