RBNZ keeps OCR on hold, policy likely to remain on hold for considerable period

May 10, 2017 22:27 pm UTC| Commentary Central Banks

As expected, the Reserve Bank of New Zealand kept its key interest rate on hold. The central bank maintained the OCR at 1.75 percent. Surprisingly, the central bank concluded that developments since the meeting in February...

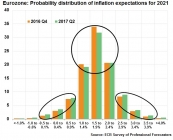

Eurozone inflation outlook improves in ECB survey, adds to the central bank's dilemma

May 10, 2017 11:59 am UTC| Insights & Views Economy Central Banks

The recently released European Central Bank (ECB) Survey of Professional Forecasters for the second quarter of 2017 shows that inflation in the eurozone will pick up in future but remain driven by volatile food and energy...

ECB’s first deposit rate hike seen in the first half of 2019, says Nordea Markets

May 10, 2017 09:41 am UTC| Commentary Central Banks Economy

The European Central Bank (ECB) is expected to adopt its first deposit rate hike in the first half of 2019, followed by a very gradual rate normalization of all policy rates. The background picture for the ECB is an...

RBNZ likely to stand pat on policy today

May 10, 2017 06:49 am UTC| Commentary Central Banks

Today Reserve Bank of New Zealand (RBNZ) will announce its monetary policy around 21:00 GMT. Over the past two years or so, RBNZ has reduced rates from 3.5 percent to 1.75 percent, which is an all-time low, however, the...

FxWirePro: The Day Ahead- 10th May 2017

May 10, 2017 04:00 am UTC| Commentary Economy Central Banks

Lots of economic data and events scheduled for today and some with high volatility risks associated. Data released so far: China: Consumer price inflation rose by 1.2 percent y/y in April. Producer price inflation...

FxWirePro: Finally some respite for SNB – Add optionality for USD/CHF and spot trade for EUR/CHF

May 09, 2017 14:19 pm UTC| Central Banks

The victory of moderate candidate Emmanuel Macron in the French presidential election has allowed the Swiss franc to depreciate significantly against the euro. This reduces the SNBs need to intervene. While we still...

FxWirePro: The Day Ahead- 9th May 2017

May 09, 2017 04:25 am UTC| Commentary Economy Central Banks

Not many economic data and events scheduled for today but some with high volatility risks associated. Data released so far: Japan: Labor cash earnings declined by 0.4 percent y/y in March. Australia: Retail...

- Market Data