National Bank of Poland keeps rates on hold, likely to keep rates unchanged until end-2018

Jul 05, 2017 22:55 pm UTC| Commentary Central Banks

The National Bank of Polands monetary policy committee kept its key interest rate on hold on Wednesday as expected. The MPC upwardly revised its central projection for this years real GDP to 4.1 percent from 3.7 percent...

FxWirePro: Delta hedging and FVAs for Jitters of TRY on surprising Turkish CPI

Jul 05, 2017 13:18 pm UTC| Central Banks Insights & Views

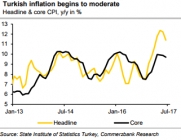

CBRT monetary policy may gradually loosen from here. After roughly 350 bps tightening since the start of the year, the central bank may have fewer reasons to maintain such a tight monetary stance in the months ahead. CPI...

Jul 05, 2017 13:16 pm UTC| Central Banks Insights & Views

We maintain our forecast for a modest and gradual appreciation in SEK which has been predicated on a strong economy leading to a slow reversal in monetary policy. Year-end Forecast for EURSEK is at 9.45 and 1H18 at 9.30...

FxWirePro: Formulate knock out optionality structure for USD/CAD bearish potential

Jul 05, 2017 11:43 am UTC| Research & Analysis Insights & Views Central Banks

The bearish USDCAD scenarios (below 1.28) driven by: BoC indicates an intention to normalize rates earlier due to an improved global outlook. Global demand pushes oil prices to $50 plus and towards $60. The...

FxWirePro: Are you dubious on further euro surge? Worthy options pack for euro bloc

Jul 05, 2017 11:34 am UTC| Central Banks Insights & Views

The economic recovery in the eurozone has strengthened and thanks to the prospect of an imminent exit from the ECBs expansionary monetary policy, after the ECB had already removed the reference to further rate cuts from...

FxWirePro: Euro call switches and options triangle strategies

Jul 05, 2017 11:30 am UTC| Central Banks Insights & Views

The economic recovery in the eurozone has strengthened and thanks to the prospect of an imminent exit from the ECBs expansionary monetary policy, EUR has appreciated. After the ECB already removed the reference to...

FxWirePro: Euro call switches and options triangle strategies

Jul 05, 2017 10:55 am UTC| Central Banks Insights & Views

The economic recovery in the eurozone has strengthened and thanks to the prospect of an imminent exit from the ECBs expansionary monetary policy, EUR has appreciated. After the ECB already removed the reference to...

- Market Data