Jul 06, 2017 13:07 pm UTC| Central Banks Insights & Views

In China, we have recently seen CAIXIN PMIs out for June month after surprising to the low side in May at 49.6, however, the parallel Jun national PMI measure did rise 0.5pts last Friday to 51.7. The balance of payments...

FxWirePro: EM central banks radar - Snippets on rate derivatives options

Jul 06, 2017 12:38 pm UTC| Research & Analysis Insights & Views Central Banks

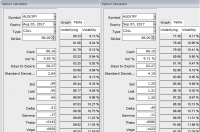

In this write-up, the central banks of EM rate expectations monitor reveal some opportunities. While EMFX implied volatility has moved higher from the multiyear lows this week and DM rates sold off. In Korea, the market...

Significant upside risk to Poland's inflation could prompt rate hike discussions at end-2017

Jul 06, 2017 11:52 am UTC| Insights & Views Economy Central Banks

The Monetary Policy Council of the National Bank of Poland (NBP) maintained interest rate at a record low 1.50 percent on Wednesday, as widely expected. The lombard rate was retained at 2.50 percent and the deposit rate at...

FxWirePro: Optionality touch for distressed AUD after recent perplexed RBA’s status quo

Jul 06, 2017 07:39 am UTC| Central Banks Insights & Views

Enduring macro trends in FX remain elusive as the passage of time has resolved few uncertainties in the past month. We expect AUDJPY to decline through 2017 on skinnier rate differentials and a pull-back in commodity...

FxWirePro: The Day Ahead- 6th July 2017

Jul 06, 2017 04:36 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today and all with low to medium volatility risks associated. Data released so far: Australia: Trade balance improves to 2.471 billion as exports increased by 9...

U.S. Fed likely to announce start of QT in September, to hike rates in December – Danske Bank

Jul 05, 2017 22:57 pm UTC| Commentary Central Banks

The FOMC minutes from the June meeting did not see anything new, as expected, as Yellen was pretty evident during the press conference following the policy announcement. The timing of the balance sheet run-off was the most...

National Bank of Poland keeps rates on hold, likely to keep rates unchanged until end-2018

Jul 05, 2017 22:55 pm UTC| Commentary Central Banks

The National Bank of Polands monetary policy committee kept its key interest rate on hold on Wednesday as expected. The MPC upwardly revised its central projection for this years real GDP to 4.1 percent from 3.7 percent...

- Market Data