Enduring macro trends in FX remain elusive as the passage of time has resolved few uncertainties in the past month.

We expect AUDJPY to decline through 2017 on skinnier rate differentials and a pull-back in commodity prices.

Australian Macro Outlook:

As expected the Reserve Bank of Australia (RBA) left its key rate unchanged early today at the record low of 1.50%. AUD nonetheless came under pressure as a result of the decision as the RBA did not signal in any way that it may consider rate hikes in the foreseeable future – contrary to many other central banks that have already changed their communication in this direction. On the other hand, it is maintaining the statement in the press release that an appreciating AUD could hamper the economic adjustment (to lower commodity prices). That means a stronger AUD remains a problem for the central bank.

The recent data flow has been mixed; retail sales slumped while building approvals bounced.

Coal prices have spiked higher in the aftermath of Cyclone Debbie, but any price rise should be temporary. Coal prices have risen by 15% in the past week, as the market takes into account the impact of supply disruptions.

Japanese Macro Outlook:

Business sentiment improved from the end of last year but remains cautious.

While the PMI rose as services strengthened and manufacturing declined.

Wage inflation has been remained anemic.

Inflation expectations have been flat since the BoJ introduced its inflation overshoot commitment.

Option Trade Recommendations:

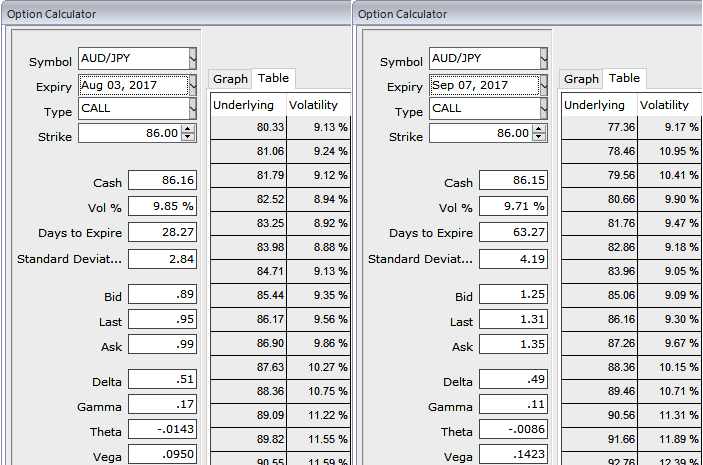

Please be noted that the IVs of ATM options trading at 9.85% and 9.71% for 1m and 3m tenors.

Buy a 6M 80.00 AUDJPY one-touch put, sell a 3M in premium-rebate notional.

Buy 3M AUDUSD ATM vs sell 1Y AUDJPY 25D Put, 1.5:1 AUD vega.

Buy 4M sell 2M AUDJPY OTM put at 83 strike in 1:0.753 notionals.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary