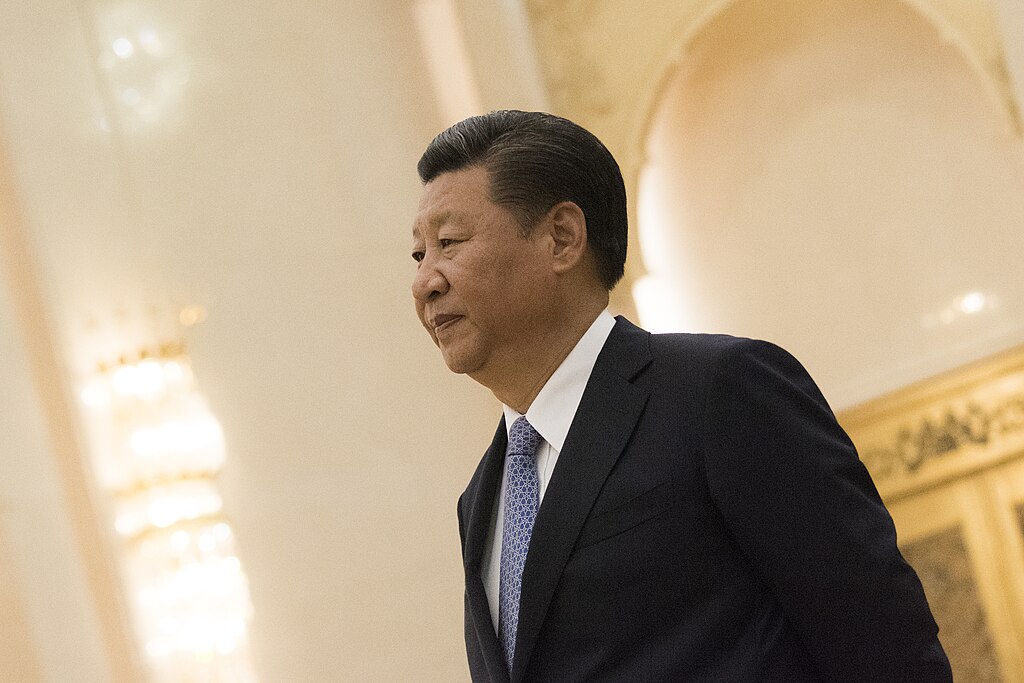

China has pledged nearly $10 billion in yuan-denominated credit lines to Latin American and Caribbean nations to strengthen development and deepen economic ties, Chinese President Xi Jinping announced at the China-CELAC Forum in Beijing. This move highlights China's strategic push to internationalize the yuan and reduce reliance on the U.S. dollar in global trade.

Addressing the ministerial meeting, Xi emphasized China’s commitment to expanding cooperation with CELAC (Community of Latin American and Caribbean States) under the Belt and Road Initiative. He noted that trade between China and Latin America surpassed $500 billion for the first time in 2024, rising from $450 billion in 2023 and just $12 billion in 2000.

The yuan-based credit will support infrastructure and investment projects, aligning with Beijing’s broader economic diplomacy. Analysts say such yuan deals—including credit swaps—facilitate cross-border transactions in RMB, offering borrowing nations an alternative to the U.S. dollar.

Xi also announced a new visa-free travel policy for five unnamed Latin American and Caribbean countries, with plans to expand the program further. This visa initiative aims to boost people-to-people exchanges and business connectivity.

During his speech, Xi welcomed both “old and new” friends and reiterated China’s support for Latin America’s greater influence in global governance. The China-CELAC Forum, launched in 2015, continues to serve as a key platform for dialogue and cooperation, fostering economic integration and strategic partnerships.

Through increased trade, financial collaboration, and diplomatic engagement, China is solidifying its presence in Latin America while advancing the global use of its currency. The move reflects a growing shift toward a multipolar world economy, where the yuan plays an increasingly central role in South-South cooperation.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement

Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift

China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift  Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil

Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding