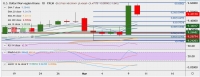

FxWirePro: EURUSD declines as market mood improves, good to sell on rallies

Mar 10, 2020 17:23 pm UTC| Technicals

EURUSD declines sharply more than 150 pips from high as market mood slightly improved this morning. US futures have shown more than 5% jump after declining more than 7% yesterday. The pair hits intraday low of 1.13323 and...

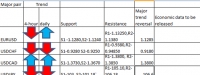

FxWirePro: Major pair levels and bias summary

Mar 10, 2020 17:20 pm UTC| Technicals

Major pair levels and bias...

FxWirePro: CHFJPY struggles to close below 200-day MA, good to buy on dips

Mar 10, 2020 11:53 am UTC| Technicals

Ichimoku Analysis (Daily chart) Tenken-Sen- 111.55 Kijun-Sen- 111.91 As per our analysis, CHFJPY surged sharply from yesterdays low of 109.54. The jump was mainly due to a slight improvement in risk...

FxWirePro: Norwegian Krone rebounds from record low as oil prices stabilize

Mar 10, 2020 11:17 am UTC| Technicals

The Norwegian Krone rebounded from record lows as oil recovered on hopes that a price war by top producers Saudi Arabia and Russia will not be sustained. The recovery in the Norwegian currency was also supported by...

FxWirePro: USD/DKK rebounds from 1-year low as greenback recovers on rising U.S. Treasury yields

Mar 10, 2020 10:52 am UTC| Technicals

The Danish Krone eased from an over 1-year peak recorded in the prior session as the greenback recovered following a rebound in the U.S. Treasuries yields. The yields on 10-year U.S. Treasuries rose to 0.63 percent,...

FxWirePro: EUR/GBP retreats from 4-1/2 month peak, finds resistance at 200-DMA

Mar 10, 2020 09:53 am UTC| Technicals

The euro declined against the British pound but remained close to 4-1/2 month peak as concerns about ongoing fractious Brexit trade talks continue to weigh on the British currency. The pair continues to struggle to...

FxWirePro: Silver moves in stiff boundaries, stay long only above $17.13 mark

Mar 10, 2020 07:31 am UTC| Technicals

XAG/USD is currently trading around $17.09 marks. It made intraday high at $17.13 and low at $16.82 levels. Intraday bias remains neutral for the moment. A daily close above $17.02 will test key resistances...

- Market Data