- The euro declined against the British pound but remained close to 4-1/2 month peak as concerns about ongoing fractious Brexit trade talks continue to weigh on the British currency.

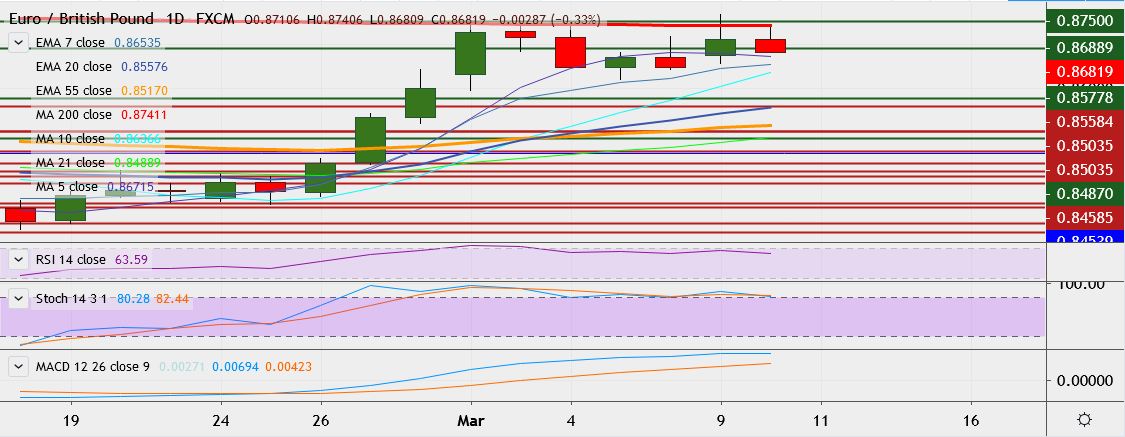

- The pair continues to struggle to sustain gains above major resistance at 200-DMA.

- Investors now await the UK government's Budget tomorrow and Bank of England policy meeting outcome on Thursday, for further cues on the economy.

- EUR/GBP is trading 0.3 percent down at 0.8684, having hit a high 0.8766 on Monday, its highest since October 14.

- Momentum indicators are bearish on hourly charts: RSI weak at 39, MACD supports downside and Stochs are biased lower.

- Immediate resistance is located at 0.8741 (200-DMA), a break above could take it near 0.8775.

- On the downside, support is seen at 0.8670, a break below could drag it till 0.8644 (7-EMA).

Recommendation: Good to sell on rallies around 0.8705 with stop loss of 0.8717, and target price of 0.8670.