FxWirePro- EURUSD Daily Outlook

Feb 10, 2023 09:44 am UTC| Technicals

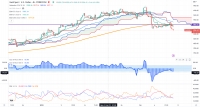

Ichimoku analysis (4-hour chart) Tenken-Sen- 1.07498 Kijun-Sen- 1.07340 EURUSD trades weak and showed a minor sell-off on surging US treasury yield. Hawkish comments from fed Chairman Powell and Fed...

FxWirePro- GBPJPY Daily Outlook

Feb 10, 2023 08:58 am UTC| Technicals

GBPJPY pared its shine on the strong yen. It hits a low of 158.08 and is currently trading around 157.86. GBPUSD- Trend- Bearish The pound sterling showed a minor pullback despite weak UK GDP. The economy has...

Feb 10, 2023 05:49 am UTC| Technicals

Ichimoku Analysis (4-hour chart) Tenken-Sen- $1874.61 Kijun-Sen- $1874.61 Gold lost its shine due to the strong US dollar. The US dollar index gained momentum after hawkish comments from Fed speakers...

FxWirePro: USD/JPY remains bid as risk-off solidifies, eyes on US data for impetus

Feb 10, 2023 05:46 am UTC| Technicals

Chart - Courtesy Trading View Softer-than-anticipated China inflation numbers have negatively impacted market risk, supporting the pair. China annual inflation data has printed at 2.1%, below forecasts at 2.2% and...

FxWirePro: EUR /NZD consolidating around 1.6970,bias is bullish

Feb 09, 2023 23:04 pm UTC| Technicals

EUR /NZD strengthened on Thursday as the pair was supported by hawkish tones from the Swedish Riksbank and comments from BoE policymakers. The euro erased earlier losses against the kiwi dollar , the pair was last up...

FxWirePro: GBP/ AUD positions for another climb, eyes 1.7550 level

Feb 09, 2023 22:39 pm UTC| Technicals

GBP/ AUD gained on Thursday as sterling was supported by hawkish rhetoric from BoE policymakers and increased risk sentiment across the board . Investors will keep a close eye on the UK gross domestic product (GDP)...

FxWirePro:GBP NZD consolidates above 1.9100 after early fall, maintains bullish bias

Feb 09, 2023 17:36 pm UTC| Technicals

GBP/NZD initially dipped on Thursday but rebounded sharply as improved risk appetite and comments from BoE policymakers lifted the pair . The pair hit daily high at 1.9162, it was last up 0.01% at 1.9136 ( GMT...

- Market Data