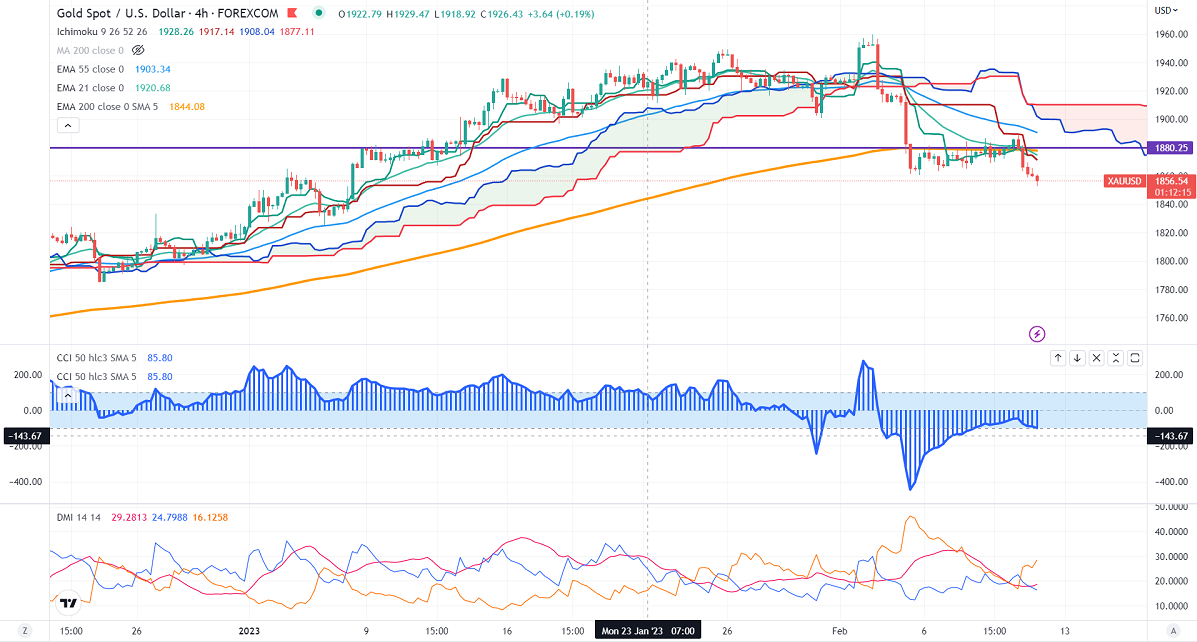

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1874.61

Kijun-Sen- $1874.61

Gold lost its shine due to the strong US dollar. The US dollar index gained momentum after hawkish comments from Fed speakers Williams and Barr. It hits an intraday low of $1852.51 and is currently trading around $1853.45.

US dollar index- Neutral. Minor support around 101.50/100.80. The near-term resistance is 104/105.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb declined to 90.8% from 82.70% a day ago.

The US 10-year yield showed a minor pullback after hitting a low of 3.57%. Any break and close above 3.69% confirm minor bullishness. The yield spread between 10 and 2-year widened to -82 basis points from -72.40 bpbs.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index –Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1860, a break below targets of $1845/1828/$1800. The yellow metal faces minor resistance around $1880, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1875 with SL around $1900 for TP of $1800.