Chart - Courtesy Trading View

Softer-than-anticipated China inflation numbers have negatively impacted market risk, supporting the pair.

China annual inflation data has printed at 2.1%, below forecasts at 2.2% and compared to the prior release of 1.8%. The monthly inflation figure has shown a deflation of 0.8% against an expansion in the inflationary pressures by 0.7%.

US dollar remains subdued after the increase in the weekly initial jobless claims, as well as the downbeat comments from Richmond Federal Reserve (Fed) President Thomas Barkin.

US Weekly Initial Jobless Claims rose to 196K versus 190K expected and 183K prior, data released by the US Department of Labor (DOL) showed on Thursday.

Further, Fed’s Barkin suggested that it would make sense for the Fed to steer "more deliberately" from here due to lagged effects of policy.

Earlier in the week, Fed Chair Jerome Powell hesitated in cheering the upbeat US jobs report and raised fears of no more hawkish moves from the US central bank.

On the other side, BoJ Governor Haruhiko Kuroda said on Friday, “The benefits of easing outweigh the costs of side effects.” He further added that policy easing was appropriate and it gave its utmost efforts."

Focus now on the United States Consumer Price Index (CPI) data, scheduled for Tuesday. The US inflation could display an upside surprise as the jobless rate is at a multi-decade low.

Forecasts call for further softening of the headline inflation to 5.8% on an annual basis vs. the prior release of 6.5%. Core inflation is seen lower at 5.3% against the former release of 5.8%.

Also, today's preliminary readings of the US Michigan Consumer Sentiment Index and 5-year Consumer Inflation Expectations for February, will be crucial for immediate directions.

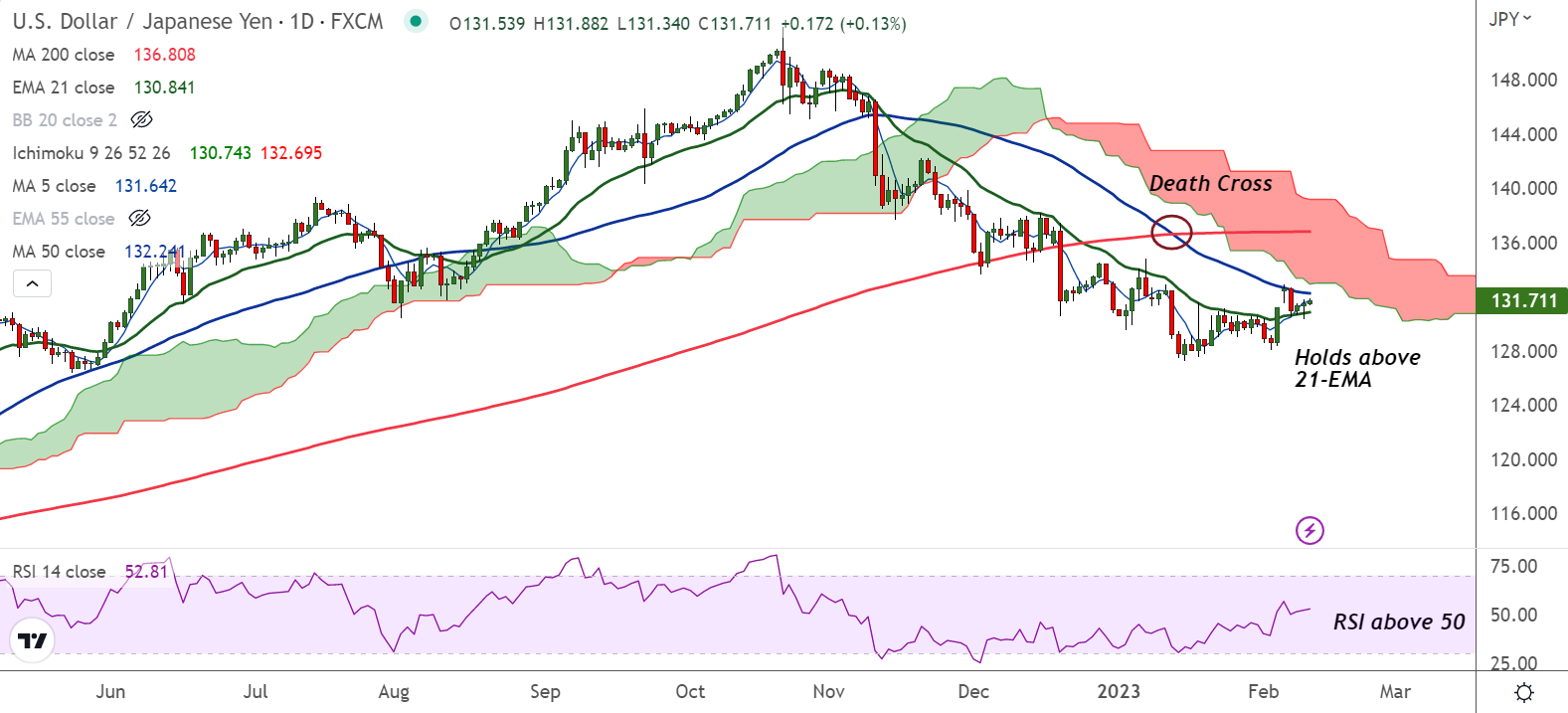

Technical Analysis:

- USD/JPY was trading 0.14% higher on the day at 131.71 at around 05:30 GMT

- The pair is extending upside grind for the 3rd consecutive session

- Price action is above 200H MA and momentum indicators are bullish

- The pair is consolidating break above 21-EMA, scope for further upside

Major Support and Resistance Levels:

Support: 130.84 (21-EMA)

Resistance: 132.24 (50-DMA)

Summary: USD/JPY poised for further upside. Immediate resistance is seen at 50-DMA at 132.24. Retrace below 21-EMA will negate any further gains.