Why global work-migration should be encouraged?

Oct 02, 2015 10:46 am UTC| Insights & Views

Encouraging global work migration is key vital step that is sure to boost economy. However politicians with their narrow national interests have so far ignored this avenue. For example, Japan stands as one of the...

Chancellor Merkel’s popularity hits four year low

Oct 02, 2015 10:16 am UTC| Insights & Views

German Chancellor Angela Merkels political rivals are cheering their way as she loses her popularity among public. What the opposition failed to do , what European debt crisis failed to do, what third bailout package offer...

FxWirePro: Indian monetary policy revivals signal IGBs lucrative investment avenue

Oct 02, 2015 10:00 am UTC| Insights & Views

An outlook on Indian: RBI governor upbeats streets expectation by both surprising policy rates cuts more than forecasted, announcing no imposition of MAT that could have an adverse impact on FIIs and foreign companies and...

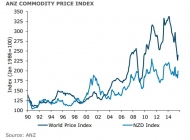

Weak Kiwi doing great to shield economy from falling commodity prices

Oct 02, 2015 09:37 am UTC| Insights & Views

Reserve Bank of New Zealand (RBNZ) is doing excellent job by showing aggressiveness in reducing rates. Since April it has reduced policy rates thrice consecutively reducing overnight cash rate (OCR) to 2.75% from...

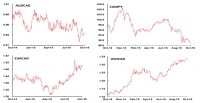

BoC to stand pat in Oct, waits for improved economic performance

Oct 02, 2015 09:34 am UTC| Insights & Views

Bank of Canada left the policy rate on hold in September after two reductions already this year, citing the weaker CAD as supportive for the economy. The statement that followed gave no hint that further accommodation was...

Oct 02, 2015 09:30 am UTC| Insights & Views

When PRBS was advised on 23rd, AUD dropped from 0.9405 to the lows of 0.9259 (you can observe that from above EOD charts), well... its not a magic, a sheer deal of analysis.With more downside potential currently the spot...

Spain registers largest on record annual decline in unemployed

Oct 02, 2015 08:39 am UTC| Insights & Views

In spite of weakness in PMI report, which showed that manufacturing PMI reached 21 month low, according to latest data from office of the public employment service, Spains unemployment is reducing fast, with economy...

- Market Data