Reserve Bank of New Zealand (RBNZ) is doing excellent job by showing aggressiveness in reducing rates. Since April it has reduced policy rates thrice consecutively reducing overnight cash rate (OCR) to 2.75% from 3.5%.

This aggressiveness is making up for the delay in response by the bank, which prematurely raised rates last year by 50 basis point, only to see both economy and inflation plunge.

Kiwi has registered sharp drop, over this assertive tone of action from RBNZ and is the worst performing developed currency this year so far. Kiwi is down more than 17% this year so far against Dollar. New Zealand Dollar is currently trading at 0.641 against Dollar, down from 0.884 back in July 2014.

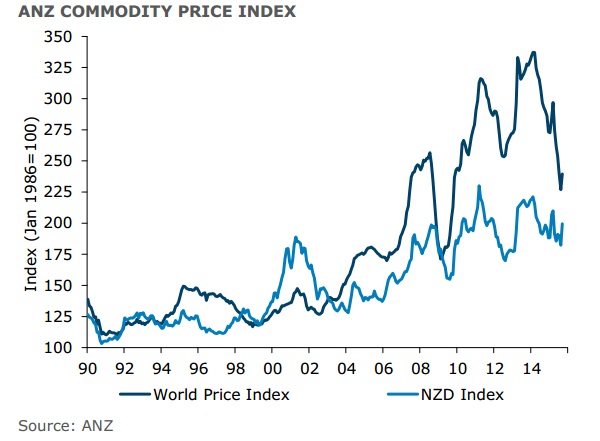

This weak Kiwi this year has working in favor of New Zealand's economy, shielding the exporters well from global commodities price slide.

Latest report from ANZ shows that, while commodity price are down -18.2% annually in September, in Kiwi terms they are up by 2.7%.

Moreover, lower prices are likely to give rise to demand which is sure to benefit New Zealand economy going ahead.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings