Bank of Canada left the policy rate on hold in September after two reductions already this year, citing the weaker CAD as supportive for the economy. The statement that followed gave no hint that further accommodation was being considered and markets have moved to price out much of the probability of a rate ease over the next 12 months.

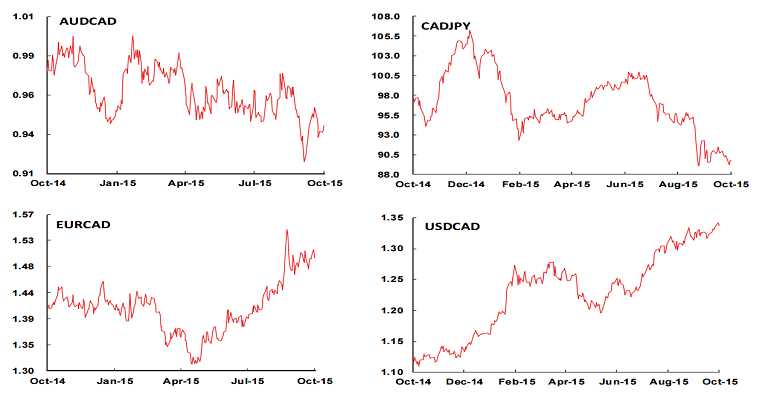

The commodity currencies have had a very poor quarter. The Canadian Dollar has fallen by over 12% against the USD year-to-date and slid below 75 cents (USD/CAD 1.33) in August for the first time since 2004. A combination of weaker commodity prices, financial market volatility and idiosyncratic issues combined to weigh heavily on the performance.

While Canada's economic performance during H1 2015 was soft, there are signs that a recovery in exports will lead a rebound in growth during the second part of the year. Statistics Canada's GDP report last Wednesday was promising. Data showed manufacturing rising 0.6% in July, following the same growth pace in June, with real output was up 0.3%, ahead of the 0.2% consensus.

That kind of growth would seem almost certain to give BOC Governor Stephen Poloz a reason to pause and hold the central bank's key policy rate at 0.5%, when the next setting and an accompanying Monetary Policy Report are published on October 21.

"We continue to anticipate that the Bank of Canada (BoC) will hold its overnight rate at 0.5% and potentially upgrade its guidance for the economy in the Monetary Policy Report due out at the October meeting", says Scotiabank in a research note to its clients.

The Canadian dollar continues to be buffeted by trends in global commodity prices and market risk sentiment. The impact of low global oil prices are apparently playing a significant role in CAD weakness. Supply/demand dynamics remain a constraint on a significant rebound in energy prices in the near-to-medium term.

In three months WTI prices are forecast to rise from 46 to 61 USD a barrel.A key driver of the Canadian outlook will of course be movements in oil prices - the CAD will find support should prices continue to rise. On the USD/CAD charts, a strong and deeply entrenched technical rally is developing, supported by firming trend intensity signals. This typically implies a sustained move (higher, in this case) is unfolding and that counter-trend corrections will be shallow and shortlived.

"USD/CAD's steady appreciation trend extended to an 11-year high in late September and we see no end to this move in sight. We expect USDCAD to reach 1.37 by the end of the year", notes Scotiabank.

The Canadian Dollar is extending its upbeat momentum against the USD on Friday, supported by rise in oil prices. But spot remains under pressure ahead of crucial U.S. non-farm payroll data. USD/CAD was trading at 1.3237 at 0920 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?