FxWirePro: Cautious USD gammas to hedge against lingering spot whirlpools

May 02, 2018 09:36 am UTC| Research & Analysis Insights & Views

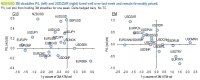

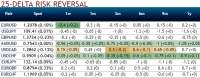

The USD pairs remain volatile with 10-year US rates on the move. However, following a week of jittery FX spot, the universe of cheap defensive plays is rapidly shrinking. Front-end USD risk reversals have almost fully...

FxWirePro: Bid 3m NZD/USD skews and deploy put ratio back spreads as Kiwis to confront headwinds

May 02, 2018 05:54 am UTC| Research & Analysis Insights & Views

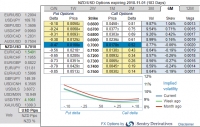

NZD faces headwinds, even in a clearly weak USD environment. Domestic growth has weakened, the central banks inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has...

Gold-i & B2C2 joint-venturing to ease hedging functionality for crypto-assets

May 01, 2018 13:28 pm UTC| Research & Analysis Insights & Views Fintech Digital Currency

Gold-i, a trading systems integration specialist for the financial services industry, has strengthened its cryptocurrency offering through a partnership with the U.K.-based market maker B2C2. Gold-i has integrated its...

FxWirePro: Restructuring GBP/USD hedging frameworks bidding on OTC updates

May 01, 2018 12:58 pm UTC| Research & Analysis Insights & Views

Briefing on technical analysis: The minor trend of cable (GBPUSD) formed rising channel and in the recent past it has broken out rising channel resistance but couldnt sustain. As a result, failure swings have dragged the...

Quantifying risks between BoE and Brexit, uphold short hedges

May 01, 2018 11:52 am UTC| Research & Analysis Insights & Views

GBP has been a notable outperformer, albeit correcting lower in recent days as a May rate hike is called into question. Intra-month cable and the GBP NEER established fresh post-referendum highs, cable jumping three cents...

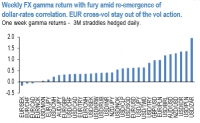

FxWirePro: Gamma back in action in tandem with softness in VXY and US yields

May 01, 2018 10:26 am UTC| Research & Analysis Insights & Views

Majority of the Asian markets are shut down for a labor holiday today. Those markets that are open are little changed following modest declines on Wall Street. The oil price is higher with Brent crude close to $75bbl on...

FxWirePro: ICO’s under the scrutiny and scanner of SEC

May 01, 2018 08:38 am UTC| Digital Currency Fintech Insights & Views

Just a week ago, SEC charged a third founder of Floyd Mayweather-backed cryptocurrency with fraud. The US regulatory authority now seems to be targeting Fraudulent ICOs. The SECs regulation facilitates capital...

- Market Data