FxWirePro: CBR shifts policy sentiments but uphold USD/RUB hedging portfolios with conviction

Apr 30, 2018 12:10 pm UTC| Research & Analysis Central Banks Insights & Views

CBR maintained status quo in its monetary policy, the base rate was on hold at 7.25% on Friday which was widely anticipated. There was little astonishment in the banks changed assessment that room for further rate cuts has...

Apr 30, 2018 11:35 am UTC| Technicals Research & Analysis Insights & Views

EURCHFs major trend has retraced from the lows of 0.9651 levels to the current 1.1970 levels. But the uptrend that was stuck in the range from last three-four months, bulls in this month have managed to break out the...

Goldman Sachs blessings in disguise, migration from Wall Street to Crypto Hedge Fund universe

Apr 30, 2018 09:58 am UTC| Digital Currency Insights & Views

BlocktowerCapital has expanded yet again in the form of head hunting the executive ranks at Goldman Sachs as the migration from Wall St. to crypto landcontinues. Cryptocurrency hedge fund BlockTower Capital keeps...

Apr 30, 2018 09:49 am UTC| Research & Analysis Insights & Views

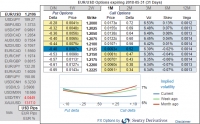

Bearish EURUSD scenarios: 1) Growth fails to rebound above 2%; 2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization 3) Eventual repatriation by US corporates. Bullish EURUSD...

FxWirePro: Unregulated Utility Tokens seemed to have been appraised by CFTC chief

Apr 30, 2018 07:14 am UTC| Research & Analysis Insights & Views Digital Currency

In a speech, delivered by CFTC commissioner Quintenz seems to embrace the concept of unregulated utility token. Brian Quintenz, of the Commodity Futures Trading Commission (CFTC), addressed the topic of cryptocurrencies...

Why that cigarette, chocolate bar, or new handbag feel so good: how pleasure affects our brain

Apr 29, 2018 14:54 pm UTC| Insights & Views Health

Every day we make a range of choices in the pursuit of pleasure: we do things that make us feel good or work in a specific job because its rewarding or pays well. These experiences help shape our perspectives on life and...

The internet is designed for corporations, not people

Apr 29, 2018 14:43 pm UTC| Insights & Views Technology

Urban spaces are often designed to be subtly hostile to certain uses. Think about, for example, the seat partitions on bus terminal benches that make it harder for the homeless to sleep there or the decorative leaves on...

- Market Data