The USD pairs remain volatile with 10-year US rates on the move. However, following a week of jittery FX spot, the universe of cheap defensive plays is rapidly shrinking. Front-end USD risk reversals have almost fully retraced back to near the January high.

At around 7.5vol handle (up about 0.4vols since last week, VXY-GL basis) front vols appear to offer more opportunities for those looking for defensive gamma hedges.

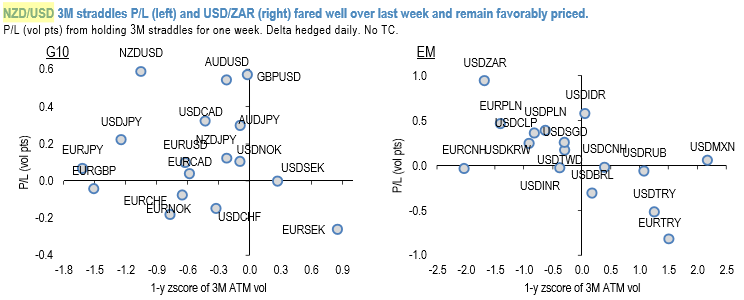

With the focus squarely on the US rates, arguably the USD vols are the place to be. To get a measure of the recent long gamma performance we look at P/L from holding 3M straddles (initiated one week ago) but we strip out the implieds vol rally component from the P/L.

An underlying assumption is that if high-frequency jitters persist (for now no sign of abating) holders of gamma straddles should see similar returns going forward.

Two additional factors to consider:

1) The vol pricing (especially on the back of the sharp really over last few days) –we assess it via 1-year z-score of ATM vols, and

2) 3M-1M roll down the vol curve – which turns out to be modest due to the recent flattening.

The above chart displays G10 and EMFX universe of 3M straddles, respectively. Unsurprisingly, high beta NZDUSD in G10 and USDZAR are two standout candidates with solid P/Ls over the past week. Both remain priced attractively (largely due to the favorably low vols prior to the ongoing vol rally).

USDJPY, a generic, catch-all risk off hedge, landed in the promising upper-left quadrant and screens cheap on implied vols (1.2 sigmas below 10Y average) but its skinny P/L and recently chronical realized vol underperformance makes as wary of yen gamma. For the time being, we pass on EUR cross vols aiming for a more direct exposure. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand