ECB expectations adding pressure on euro

Nov 30, 2015 11:56 am UTC| Commentary Central Banks

When the ECB launched its 1.1trillion QE programme in March, purchasing 60bn of bonds a month, euro area inflation stood at a minus 0.1pct and has since climbed to 0.1pct, well below the ECB target. In a speech last week...

Volatile volatility too volatile this year

Nov 30, 2015 11:49 am UTC| Commentary

Volatility, which is known as VIX in financial market is a measure of market movement (SP500, rather expected market movement using option price. Using reverse Black Sholes equation and options price in the market, VIX or...

Nov 30, 2015 11:22 am UTC| Commentary

The geo-political tensions between Turkey and Russia were not supportive to the oil prices, which are now continuing to fall. The current supply glut, lack of prospects of rapid improvement despite OPEC meeting, strong...

Renminbi series – Yuan into SDR – at what weightage?

Nov 30, 2015 11:01 am UTC| Commentary

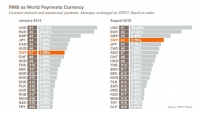

Mega announcement for the year is scheduled for November, today, when International Monetary Fund (IMF) will take decision in its review, whether to add Chinese currency Yuan or Renminbi in its Special drawing Rights (SDR)...

Nov 30, 2015 09:57 am UTC| Commentary

Today is a big day for International Monetary Fund (IMF) and China, as formers board of governors are scheduled to meet today and take a decision on staff recommendation, whether to include Yuan in IMFs Special Drawing...

Volatility is back in Chinese stock market

Nov 30, 2015 09:50 am UTC| Commentary

Memories of June to August are coming back, when Chinese market used to drop sharply in the afternoon session, followed by subsequent recovery. Today in the afternoon session, Chinese benchmark stock index, Shanghai...

RBA likely to end the year on hold

Nov 30, 2015 09:27 am UTC| Commentary Central Banks

There is final Reserve Bank of Australias meeting tomorrow, in which the Governor speaks on the economy the next day, just before the release of the GDP for third quarter of this year. We still expect the RBA to remain...

- Market Data