Mega announcement for the year is scheduled for November, today, when International Monetary Fund (IMF) will take decision in its review, whether to add Chinese currency Yuan or Renminbi in its Special drawing Rights (SDR) or not.

If IMF choose to include Yuan, in its SDR basket, it would be a milestone decision and the impact will not only be felt in financial markets but to global trade as well as geo-politics.

In previous parts, named Renminbi series: Yuan into SDR, we discussed general facts on SDR and Yuan's probable inclusion in the basket, near term possibilities of the addition and why it's a done deal.

One thing can be said with certainty, impact of an inclusion will reverberate globally through years to come.

Key question, lot of people would be looking at, what could be the weightage given to Yuan in SDR basket.

Current composition -

As of latest, which will probably get changed after today's meeting, highest weightage is given to Dollar (41.9%), followed by Euro (37.4%), Pound (11.3%) and Yen (9.4%).

Market chatter -

After staff recommendation report, some talks in the market suggest that weightage given to yuan could be as high as 14%, surpassing both Yen and Pound.

FxWirePro's assessment -

While taking decision on the weightage of Yuan, IMF will not only consider large export and import size of China but also on the Yuan's status in global payments, liquidity and depth of Yuan in market, accessibility as well as convertibility.

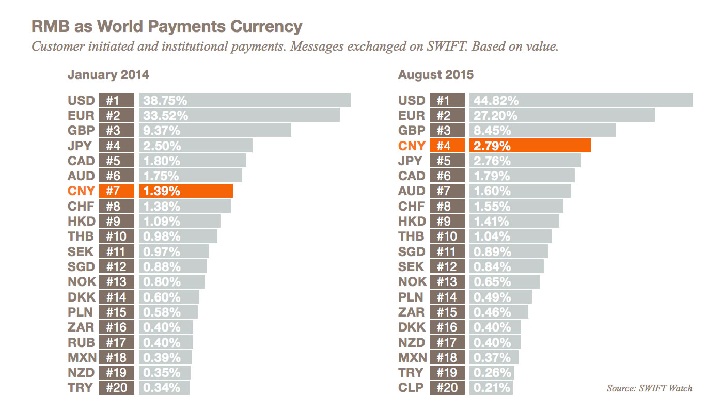

Yaun's rise in global settlements have been quite dramatic and jaw dropping.

Back in January 2012, Yuan ranked 20th among currencies used in global payments accounting only 0.25% all the payments. But by October 2013, it ranked 12th, accounting for 0.845 of global payments.

By April, 2014, Yuan's rank rose to seventh globally, accounting for 1.43% of global payments. By 2015, Yuan was among top five challenging Yen's rank.

As of latest data available to us for August 2015, Yuan has surpassed much liquid counterpart Yen in global payments accounting for 2.79% of all transactions, while Yen accounted for 2.76%.

While rise of Yuan in global payments, likely to demand higher weightage of Yuan in IMF's basket, there other considerations.

In spite of recent reforms pursued by People's Bank of China (PBoC) to make Yuan more accessible, convertible and liquid, Yuan remains way far from other counterparts in IMF's basket. Moreover, PBoC still keeps quite a tight grip on Yuan's everyday movement.

Based on these two key factors, our view is Yuan will have a weightage between Sterling and Yen, somewhere between 9-10%. Yen and Euro's weightage are likely to go down more.

IMF will probably finalize the weightage in next year's adjustment meeting.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022