Volatility, which is known as VIX in financial market is a measure of market movement (S&P500, rather expected market movement using option price. Using reverse Black Sholes equation and options price in the market, VIX or the implied volatility is measured. It is market based assumption of volatility.

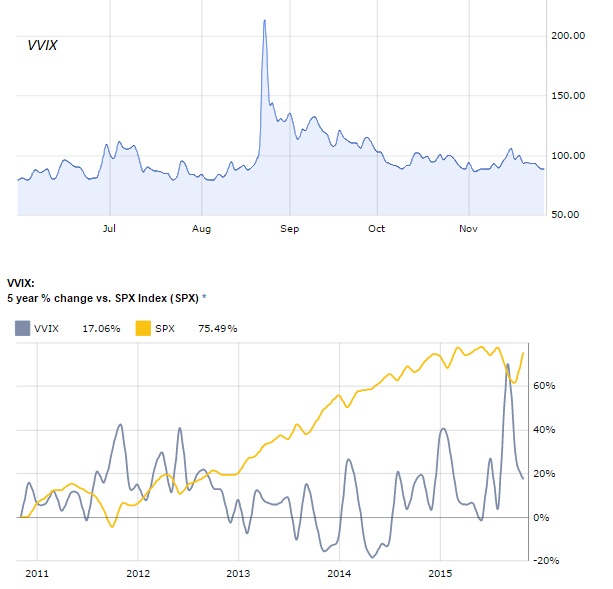

To measure the volatility of volatility, similar method is used for determination and the measure is known as VVIX.

In the strange world of monetary easing, volatility has become suppressed until recently as FED is on its way to hike rates, which would mean official end of stimulus policy. After QE, selling the volatility has become one of the central themes of hedge funds, asset managers even some retailers too. Volatility has become another asset.

At any sell offs, while market is getting sold off, volatility is getting bought too and further skewing the movement in volatility.

Bloomberg's Tracy Alloway, in her article on anomalies (this volatility phenomenon is one such), which you can read at http://www.bloomberg.com/news/articles/2015-11-12/five-strange-things-that-have-been-happening-in-financial-markets, points to an anomaly of volatility pricing.

She notes that back in the time when Lehman collapsed and whole financial market was about to get flushed away, VIX recorded 134.87 and that got surpassed in August 2015 as VIX closed at 168.75, while market dropped 5.3%.Since volatility (VIX) itself became an asset class, post monetary easing and finding the equilibrium is now much more complicated process.

We at FxWirePro, noted in data from CBOE that VVIX change this year has reached all-time record and that during the massive sell-offs in August and the rising trend denotes that if Tracy Alloy's suggestions are right (which we think is), then these short volatility managers are slowly getting more tensed over the trade.

One stark difference from 2008 is that back then, everyone was pretty sure post - Lehman, that the world (stocks) going to get wiped out, 1929 depression is coming back (which thankfully didn't). But in today's world of central banks' bubbly balance sheet, investors and traders are not too sure where it's headed.

It's a new world of good is bad, bad is good. For example, all central banks are looking (rather hunting) to boost inflation and growth. So if they come.....that's good but it would mean $25 trillion of asset purchase money take reverse course, pace could differ but reverse for sure (ohh.... nooo....that's bad).

Our view is that this rising volatility of volatility might be indicating that people are getting tense over this uncertain certainty.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX