RBNZ cut the OCR to 2.5%, does not expect to cut the OCR further

Dec 09, 2015 23:49 pm UTC| Commentary

The RBNZ does not expect to cut the OCR further, but stands ready to do so if the economic situation were to change. The RBNZs press release included a key phrase that "We expect to achieve [2% inflation] at current...

RBA to stay on hold as the risks transition

Dec 09, 2015 23:16 pm UTC| Commentary Central Banks

The RBA will likely look through any significant acceleration of tradable inflation. Any acceleration in the targeted core measure of inflation is expected to be much more modest, only returning to the midpoint of the 2-3%...

Australia's inflation to accelerate as A$ pass-through finally arrives

Dec 09, 2015 23:01 pm UTC| Commentary

In an environment where domestic demand is relatively modest, non-tradable inflation is expected to remain well in check. Wages growth will be unlikely to accelerate from a 2.0-2.5% yoy range as spare capacity in terms of...

Bank of England will need to consider Brexit risks

Dec 09, 2015 22:33 pm UTC| Commentary Central Banks

The uncertainty generated ahead of the referendum may not be the perfect recipe for growth. The Bank of England will need to take that into account. For instance, the BoE said in 2012 that the most extreme potential...

Dec 09, 2015 22:23 pm UTC| Commentary

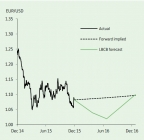

2016 looks set to be another volatile year for EUR/USD. While the crisis in Greece has, for now, abated, a renewed escalation of tensions across many of the highly-indebted euro area countries remains a key risk as...

Stronger euro area domestic demand to lead the recovery in 2016

Dec 09, 2015 21:52 pm UTC| Commentary

The economy is anticipated to expand by 1.5% in 2015, which would be at the high end of forecasts made at the start of the year. The growth rate is expected to rise to 1.8% in 2016 and 1.9% in 2017, supported by stronger...

Euro Area monetary policy to remain accommodative

Dec 09, 2015 21:39 pm UTC| Commentary

The ECBs quantitative easing programme, which began in March 2015, consisting of 60bn a month of asset purchases (mainly government bonds), has helped to reduce deflation risks, even while further falls in global oil...

- Market Data