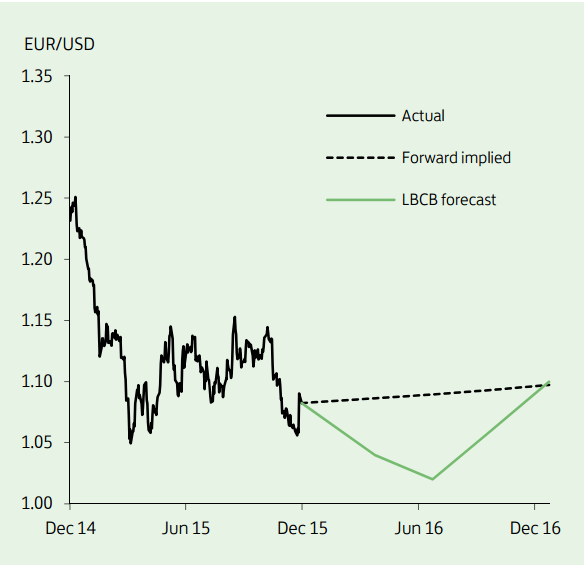

2016 looks set to be another volatile year for EUR/USD. While the crisis in Greece has, for now, abated, a renewed escalation of tensions across many of the highly-indebted euro area countries remains a key risk as opposition to rising immigration and fiscal austerity is mounting. Add to this the possibility of more QE as the ECB attempts to reflate, and a steady increase in US interest rates, and the line of least resistance is for the euro to weaken further.

"We look for EUR/USD to retest the lows below 1.05 in the early months of 2016", notes Lloyds Bank.

Indeed, a break below parity cannot be ruled out if the Fed tightens monetary policy more aggressively than the market currently anticipate. While the risks for the euro remain to the downside for now, over the medium to longer term, it is believed that the euro looks oversold.

Fundamental estimates of fair value for EUR/USD centre around 1.20 to 1.30. But it is likely to take clear signs of a recovery in 'core' euro area inflation, firmer signs of economic recovery and an associated narrowing in US and euro area rate spreads to push the euro meaningfully higher.

"We target 1.04 by end Q1 2016 and 1.10 by the end of next year", added Lloyds Bank.

EUR/USD Outlook

Wednesday, December 9, 2015 10:23 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed