Lack of liquidity causes concern for EM pairs

Jan 14, 2016 21:52 pm UTC| Commentary

There is no development with respect to bid-ask spreads in EM currencies, for an example, USD/BRL, USD/ZAR and even USD/MXN. The spread of such EM pairs are widening. This indicates that liquidity is at a premium even for...

Hungary's MNB to continue easing bias policy in 2016

Jan 14, 2016 21:16 pm UTC| Commentary Central Banks

While looking at the current economic condition in Hungary and free fall of Oil prices, further interest rate cut is expected, says MNB economist. As per the forecast, the Hungarian base rate is expected to cut from 1.35%...

Will Nordic EUR catch up with peers?

Jan 14, 2016 18:08 pm UTC| Commentary

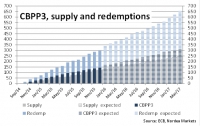

As the CBPP3 continues to gobble up bonds, this continues to leave a significant mark on the market. Liquidity has been reduced and spreads on covered bonds from the Euro area trade at tighter levels than peers. But with a...

Timing of future Fed rate hikes gets murkier

Jan 14, 2016 17:04 pm UTC| Commentary Central Banks

Further interest rate hikes by the U.S. Federal Reserve should be gradual or they risk hurting already fragile emerging economies. Specifically, if oil prices remain at current levels or fall even lower, it is doubtful the...

Commodities more likely than sterling to boost UK equities

Jan 14, 2016 17:03 pm UTC| Commentary

It might seem surprising that the UK stock market has outperformed its peers recently, given the ongoing pressure on commodity prices. After all, the share of firms listed in the oil gas and basic materials sectors is...

US economy will likely return to full employment by mid-2016

Jan 14, 2016 16:27 pm UTC| Commentary Economy

US unemployment rate, currently at 5% is already close to the Feds estimate of the NAIRU, the level consistent with full employment. However, the broader so-called U-6 underemployment measure is at 9.9% suggests that some...

Banxico unlikely to increase intervention amount at this stage

Jan 14, 2016 16:01 pm UTC| Commentary Central Banks

Banxico, as of today, sells 200mn USDMXN at a minimum price of +1.0% above the previous-day FIX and an additional 200m at +1.5%. The Central Bank is likely to fine-tune its FX interventions, will likely make operational...

- Market Data