As the CBPP3 continues to gobble up bonds, this continues to leave a significant mark on the market. Liquidity has been reduced and spreads on covered bonds from the Euro area trade at tighter levels than peers. But with a current end-date of March 2017 the impact from the CBPP3 is very likely to fade, and this should increasingly leave bonds not included in the CBPP3 more attractive.

As the ECB via the CBPP3 owns an ever-larger share of the market, liquidity in that same market has been eroded, and investors once present have been forced out as yields and spreads are kept unnaturally low. Even the talk of the ECB having boosted supply could be questioned. Looking at issuance in 2014 (before the CBPP3 started) supply was healthy and on the increase compared to 2013. Plainly put, the market was not in the need of a supporting covered bond purchase programme.

The above highlights the dilemma as to the purpose of the CBPP3. Is it merely a part of the ECB's balance sheet target or is the purpose to aid funding? The CBPP3 should not be viewed as a construct supporting the covered bond market. It should be viewed as part of the ECB's objective in reaching their balance sheet target, the aim of which is to push inflation higher.

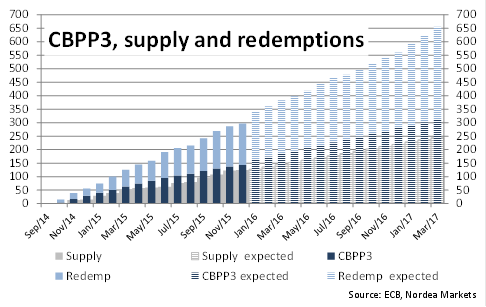

Previously it is estimated that by the end of September the ECB would own 40% of the Euro-area covered bond market, including legacy covered bond programmes. If the CBPP3 continues unchanged until March 2017, this figure will have risen to between 45-50%. These are large amounts, and, this could easily have a negative impact on bonds eligible for the CBPP3 as we approach the end of 2016.

"We expect EUR 21bn from the Nordics and EUR 103bn from the Euro area, including the UK. Net supply in the Nordics will be positive with EUR 18bn maturing, but negative in the Euro area (including the UK). If we were to include overseas supply (Canada, Australia and New Zealand), we are close to status quo", says Nordea Research.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022