China’s real GDP growth likely to decelerate to 6.4% in 2016

Feb 02, 2016 12:26 pm UTC| Commentary

Chinese economy is seen as a crucial source for global economic growth. Growing concerns over the economy will hurt investor sentiments as they will be wary on volatility in financial market conditions and challenges...

ECB alone can’t fight employment fragmentation in member states

Feb 02, 2016 12:19 pm UTC| Commentary Central Banks

Latest unemployment report released from Eurostat for December month, show employment improved to levels last seen during 2011. Overall unemployment rate in the region dropped to 10.4%, which is a remarkable improvement,...

Brexit risks: justified or overestimated; Part 4

Feb 02, 2016 11:41 am UTC| Commentary

In our previous parts to Brexit risks, available at http://www.econotimes.com/Brexit-risks-%E2%80%93-justified-or-overestimated-%E2%80%93-Part-1-140164 and...

Futures market likely driven by commodity prices and Chinese growth

Feb 02, 2016 11:40 am UTC| Commentary

In January, the Japanese yen traded in the positive zone for the first time since October 2012 and continued to advance higher levels, until the BoJs surprised the market by adopting negative interest rate at the end of...

Feb 02, 2016 11:39 am UTC| Commentary

Several key event risks are ahead of New Zealand Dollar today, which could push New Zealand Dollar down again. New Zealand Dollar is already trading down almost 1% against Dollar, at 0.649. ANZ commodity prices released...

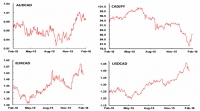

Worst has passed for CAD, dips are a buying opportunity

Feb 02, 2016 11:24 am UTC| Commentary

The loonie lost over 15% of its value versus the U.S. dollar, Japanese Yen and British pound in the previous year. The sell-off in the CAD was looking extended from a quantitative, as well as qualitative perspective. The...

India’s inflation rate likely to decelerate in the forthcoming months

Feb 02, 2016 11:04 am UTC| Commentary

The Reserve Bank of India had cut its benchmark interest rate by 50 basis points to 6.75 percent last in September 2015, and is likely to be accommodative in the forthcoming months. Even after having a favourable inflation...

- Market Data