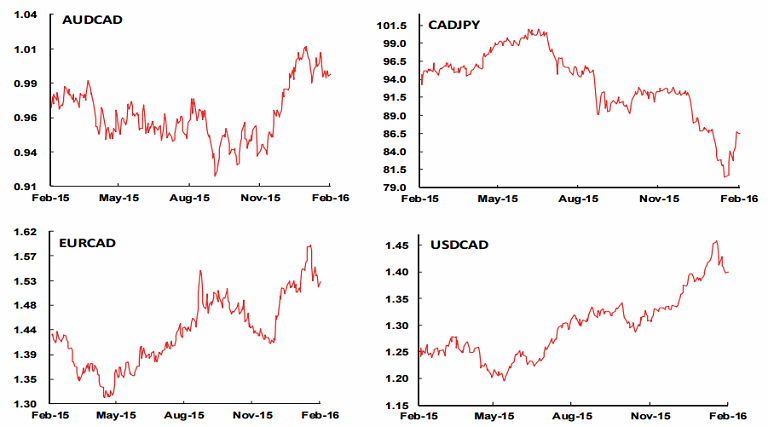

The loonie lost over 15% of its value versus the U.S. dollar, Japanese Yen and British pound in the previous year. The sell-off in the CAD was looking extended from a quantitative, as well as qualitative perspective. The Canadian dollar is not seen this cheap since 2004. The biggest problem for Canada has and will continue to be oil. However, unchanged Bank of Canada monetary policy settings, reiterated BoC Governor Poloz's believes that stronger U.S. growth, a weaker Canadian dollar and rate cuts delivered in the first half of 2015 will help the economy recover and avoid the need for unconventional policies such as quantitative easing. The central bank is now waiting to see if fiscal policy would pick up the baton to try and drive the economy forward. The central bank's confidence as well as steadier crude oil prices have helped stabilize the CAD.

The ongoing discussion since mid last week about coordinated production cuts by Russia and OPEC saw oil prices stabilizing. We have also seen a bounce in Canadian interest rates (as market conviction regarding BoC easing risks fell) and a drop in US interest rates (as investors debate the pace of Fed tightening amid renewed equity market volatility). Better data and narrower rate spreads (the 2-year bond yield differential narrowed around 20 bps from the early January peak to around 40 bps) provided the fundamental foundation for a rebound in the CAD.

The risk is clearly geared towards more CAD weakness, USD/CAD is likely to strengthen significantly in the early stages of the calendar year. 1.42/1.45 levels for USD/CAD should not be a surprise before the end of Q1 before some consolidation sets in through Q2/Q3. The USD rally extended through late January, reaching a peak just under 1.47 (near 68 cents US) as oil prices remained under pressure. The USD/CAD rally through January took the USD to a little more than 30% above its 10-year moving average. From a qualitative perspective, relative data surprises started to shift against the USD through January as Canadian data surpassed forecasts (international trade, jobs, whole sale trade, manufacturing sales, for example).

"We remain reluctant to alter our view, implying that the CAD will steady through Q1. We think markets will remain volatile, however, and do not exclude the risk of the USD retesting levels near the recent highs against the CAD in the next few weeks. We rather think the worst has passed for the CAD, however, and that near-term losses are a buying opportunity", notes Scotiabank in a research report.

The Canadian dollar improved for a third straight week, as USD/CAD dropped over 600 pips from 1.4690 on Jan 20th to currently trade around 1.40 levels as of 1115 GMT.

Worst has passed for CAD, dips are a buying opportunity

Tuesday, February 2, 2016 11:24 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed