SNB keeps rates unchanged, slightly lowers projection for 2016 GDP growth and inflation

Mar 17, 2016 11:48 am UTC| Commentary

The Swiss National Bank (SNB) today kept the sight deposit rate on hold at -0.75% and the 3m-Libor target range at -0.25% to -1.25%, on par with expectations. The backdrop for the meeting was similar to the Decembers, as...

BSP to keep overnight rates on hold, likely to hike in H2 2016

Mar 17, 2016 11:25 am UTC| Commentary

The Philippines central bank is likely to keep its overnight rates on hold again at 4% (RRP) and 6% (RP) together with the special deposit account at 2.50%. The BSP is not expected to change rates in H1 2016 with the...

FED Hike Aftermath Series: hike probabilities review

Mar 17, 2016 10:37 am UTC| Commentary Central Banks

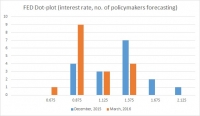

Back in December, after FED hiked rates by 25 basis points, Market was pricing two more hikes in 2016, while FEDs dot-plot was predicting four. Since then lot has happened. As market faced heavy turmoil in January and...

Sweden’s unemployment rises unexpectedly in February, above Riksbank’s view

Mar 17, 2016 10:28 am UTC| Commentary

Swedens jobless rate grew unexpectedly in February as employment disappointed. Unemployment is above the Riksbanks view. Februarys seasonally adjusted jobless rate reached 7.1%, more than consensus expectation of 7%....

Norges Bank lowers interest rate and rate path, likely to cut rates again

Mar 17, 2016 10:09 am UTC| Commentary

As broadly expected Norges Bank lowered its rates today by 25bp to 0.5% and lowered the rate path to a bottom of 0.2% in Q1 2017. This indicates that there is a 100% possibility that the central bank will further lower...

Mar 17, 2016 10:05 am UTC| Commentary

In H2 2015, the New Zealand economy has had a reasonable run of growth after a slow start to the year. New Zealands economy expanded 0.9% in Q4, matching the growth in Q3 and exceeding market forecasts of a growth of 0.7%....

FED Hike Aftermath Series: Dot-plot magic downs Dollar

Mar 17, 2016 09:42 am UTC| Commentary Central Banks

FEDs dot plot, which represents policymakers expectation of future rates going forwards is working its magic but not in favor of Dollar, this time around. Reason is simple, all of Federal Open Market committee (FOMC)...

- Market Data