BI should ease pace of easing policy, should wait until Q2 to cut rates

Mar 18, 2016 06:57 am UTC| Commentary Central Banks

Bank Indonesia (BI) lowered its rate for the third consecutive time yesterday, cutting its entire policy corridor by 25bps, with the reference, Fasbi/deposit and repo rates being lowered to 6.75%, 4.75% and 7.25%...

FxWirePro long term outlook: Extending USD/JPY target to 90

Mar 18, 2016 06:26 am UTC| Commentary

Anybody who could recall our previous call Sell USD/JPY at 118 and at rallies with stop loss around 126 and target around 98. Will easily be able to relate to this extension, those who are not can check out the...

Japanese economic outlook remains weak, mainly driven by struggling consumer

Mar 18, 2016 06:25 am UTC| Commentary

The economic outlook for Japan continues to be weak. In Q4 2015, the nations real GDP growth entered the negative territory again as output fell 0.3% q/q and grew 0.8% y/y after a growth of 0.3% q/q and 1.7% y/y in Q3. The...

Guide to today’s important data and events

Mar 18, 2016 05:57 am UTC| Commentary

Not many economic dockets scheduled for today and most with low to medium risks associated. Data released so far China House prices rose by 3.6% in February. Upcoming Germany ...

Euro area economic recovery to continue at moderate pace, private consumption drives growth

Mar 18, 2016 05:36 am UTC| Commentary

The euro area economic recovery, which had started in Q2 2013, is entering its fourth year now. When it started, the jobless rate in the currency bloc was 12%, as compared to the most recent figure of 10.3%. Clearly, there...

Nikkei falls as Yen continues to gain against US dollar, Other Asian markets higher

Mar 18, 2016 03:11 am UTC| Commentary

Asian markets are trading on a mix note on Friday as Nikkei falls and on the other hand China gains. In addition, Gold finds support above $1260 marks and USD/JPY is hovers around 111.00 marks. The Nikkei 225 index...

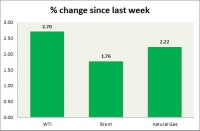

Mar 17, 2016 15:48 pm UTC| Commentary

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI likely to move higher but unlikely to cross $42-45 area in this run. Today it is riding on weaker...

- Market Data