Polish central bank likely to lower rates by Q3, lowers inflation outlook for 2016, 2017

Mar 14, 2016 09:51 am UTC| Commentary Central Banks

Polands central bank, during its meeting on Friday, kept its policy unchanged and hinted a likely reduction in rate if there is excessive capital inflow from euro area. The central bank cut its inflation forecasts as...

Bank of Japan unlikely to make changes to monetary policy tomorrow

Mar 14, 2016 09:42 am UTC| Commentary Central Banks

The Bank of Japan is unlikely to make any changes to its monetary policy. The central bank is expected to keep its promise of raising the monetary base by JPY 80 trillion on an annual basis and to apply negative rate of...

Stock market enjoys ECB package while Euro remains defiant

Mar 11, 2016 12:59 pm UTC| Commentary Central Banks

Euro is down today, but after last nights big rally, itwill only be fair to call todays move as throw away and largely expected at the end of the week, but stock markets have begun enjoying the ECB package gaining back...

US Fed unlikely to hike rates next week, but high probability of hike in April or June

Mar 11, 2016 12:39 pm UTC| Commentary Central Banks

Since FOMCs January meeting, financial conditions have noticeably eased. The committee had become more dovish in January, erasing around half of the tightening that came after the first hike in December. However, according...

Bank of Mexico to follow US Fed’s policy strategy, to keep rates on hold next week

Mar 11, 2016 12:13 pm UTC| Commentary Central Banks

The Bank of Mexico is expected to follow the US Feds move and keep the overnight rate on hold at 3.75% next week. It is likely to issue a relatively dovish statement in terms of growth but slightly more hawkish in terms of...

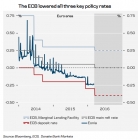

Euro strength inconsistent with the comprehensive ECB package, an overreaction, downside to resume

Mar 11, 2016 12:09 pm UTC| Commentary Central Banks

The ECB fired its bazooka yesterday, and undoubtedly a powerful one, yet markets were unimpressed. As expected, the ECB cut its deposit rate by 10 basis points, further into negative territory to -0.4%. The marginal...

South African Reserve Bank likely to proceed with rate hike cycle in 2016

Mar 11, 2016 11:25 am UTC| Commentary Central Banks

The South African Reserve Bank is expected to hike its key rate to 7% as the high CPI inflation outlook continues to pressurize the central bank to go ahead with its rate hike cycle. According to the MPC, the South African...

- Market Data