Bank of England announces aggressive monetary and quantitative easing steps

Aug 04, 2016 12:23 pm UTC| Insights & Views Central Banks Commentary

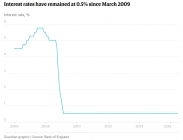

Bank of England Monetary Policy Committee voted unanimously to cut interest rates by 25 basis points to a new record low of 0.25 percent as widely expected by the markets. This was the central banks first cut since 2009....

Bank of England eases policy with prudence and surprise

Aug 04, 2016 11:20 am UTC| Commentary Central Banks

The Bank of England (BoE) successfully handled the demand for easing and was successful in surprising the market, even if by a little. In addition to that it has taken up other measures, which are prudent and will ease the...

ECB warns of uncertain global outlook in its economic bulletin

Aug 04, 2016 10:55 am UTC| Commentary Central Banks

According to the monthly economic bulletin released by the European Central Bank, incoming data for the second quarter point to subdued global activity and trade. Also, risks to outlook for global activity and EMs in...

Bank of England to boost confidence; not to surprise the markets

Aug 04, 2016 10:27 am UTC| Commentary Central Banks

The Bank of England (BoE) is set to deliver its much awaited August policy decision today at 11:00 GMT and it is widely expected that the bank will talkesome actions in response to UK referendum that resulted in majority...

Bundesbank chief Jens Weidmann warns of upside risks to interest rates

Aug 04, 2016 08:07 am UTC| Commentary Central Banks

European Central Banks (ECB) most hawkish and one of the most respected and reputed central bankers, Bundesbank chief Jens Weidmann has warned against thesharp reversal in global interest rates and warned that they could...

Japan services PMI crosses 50-point mark on rise in new orders

Aug 03, 2016 13:11 pm UTC| Central Banks

Japans services Purchasing Managers Index (PMI) crossed the 50-point mark during the month of July, a sign of optimism after the contraction witnessed last month as companies shrugged off business backlogs amid a steady...

Revision to inflation and growth forecasts by BoE along with forward guidance to drive GBP action

Aug 03, 2016 13:05 pm UTC| Insights & Views Central Banks

Markets await Bank of Englands (BoE) policy decision on Thursday, 4th August. The BoE is likely to become the first central bank to take action in response to the referendum. Amid the heightened uncertainty, expectations...

- Market Data