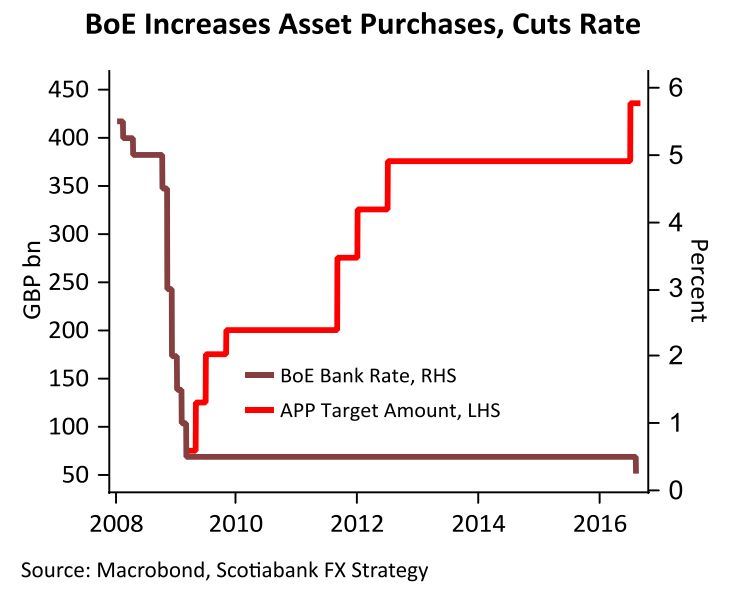

Bank of England Monetary Policy Committee voted unanimously to cut interest rates by 25 basis points to a new record low of 0.25 percent as widely expected by the markets. This was the central bank's first cut since 2009. BoE launched two new schemes, one to buy 10 billion pounds of high-grade corporate bonds and another - potentially worth up to 100 billion pounds - to ensure banks keep lending even after the cut in interest rates.

The central bank said it expected the economy to stagnate for the rest of 2016 and suffer weak growth throughout next year. Most MPC members also expected to cut Bank Rate again this year to a rate "close to, but a little above zero", if the economy performed as poorly as forecast. However, policymakers were not completely united on how to respond.

The BoE left its forecast for growth this year steady at 2.0 percent. But 2017 saw a sharp downgrade to a growth of just 0.8 percent from a previous estimate of 2.3 percent - the biggest downgrade in growth from one inflation report to the next, exceeding what was seen in the financial crisis. The growth outlook for 2018 was cut to 1.8 percent. Inflation forecasts were also sharply revised higher due to the big fall in sterling since the financial crisis. The MPC said the costs of trying to bring it back to its 2 percent target in the immediate future would exceed the benefit.

The MPC added that the terms and length of the scheme could be adjusted, which is funded by central bank reserves and that the value of lending will be determined by usage of the scheme and could reach around 100 billion pounds. Despite the further easing measures in the pipeline, questions remain on whether QE and rate cuts will help prop up the British economy.

"The uncertainty created by the Brexit referendum result cannot be addressed by small changes in interest rates or other monetary measures. It requires a political response from the government, to make clear the nature of our future relationship with the EU - which will inevitably take time. There are some circumstances when a central bank can do little to offset the shock to the economy and the resulting uncertainty, and that is the case now." said Andrew Sentance, senior economic adviser at PwC.

The rate cut was fully priced in, but the size of the extension to its quantitative easing stimulus left room for reaction in the sterling. GBP/USD declined sharply from the high off 1.3374 to 1.3111, while stocks edged higher. The pan-European STOXX 600 was up 0.8 percent with all major bourses in positive territory.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal