Fundamentals to watch out for this week

Nov 12, 2018 13:12 pm UTC| Commentary Central Banks

In terms of volatility risks, this week is relatively light thanks to low key events and data. Nevertheless, as a trader What to watch for over the coming days: Central Banks: Several Federal Reserves speakers...

Fed Hike aftermath Series: Hike probabilities over coming meetings

Nov 12, 2018 04:34 am UTC| Commentary Central Banks

FOMC increased interest rates in March, June and in September. Increased its forecast from three rate hikes in 2018 to four rate hikes. September decision was unanimous. Current Federal funds rate - 200-225 bps (Note, all...

FxWirePro: The Day Ahead- 12th November 2018

Nov 12, 2018 04:13 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today as the United States is on a holiday, and all with low to medium volatility risks associated. Upcoming: Japan: October Machine tools orders report will be...

Bank Negara Malaysia keeps interest rate on hold, likely to maintain neutral tone through 2019

Nov 08, 2018 13:24 pm UTC| Commentary Central Banks

The Malaysian central bank, Bank Negara Malaysia, kept its Overnight Policy Rate on hold at 3.25 percent, as was widely anticipated. The central bank maintained that the global growth continues albeit with signs of...

RBNZ monetary policy: Assessing future bias

Nov 08, 2018 12:49 pm UTC| Commentary Central Banks

At todays meeting, Reserve bank of New Zealand (RBNZ) kept monetary policy unchanged with overnight cash rate at 1.75 percent. Lets see in the monetary policy, how the bias stands for future actions, The pick-up...

FxWirePro: What to watch in FOMC meet ahead?

Nov 08, 2018 10:48 am UTC| Commentary Central Banks

The U.S. Federal Reserve is in a hawkish mode. Since December 2015, the U.S. Federal Reserve has hiked rates eight times. It has hiked rates thrice this year in unanimous voting and forecasted one more hike over the...

Nov 06, 2018 09:06 am UTC| Commentary Central Banks Economy

The central bank of Philippines is expected to adopt a final rate hike of 25 basis points to 4.75 percent at their December monetary policy meeting, according to the latest report from ANZ Research. At 6.7 percent y/y...

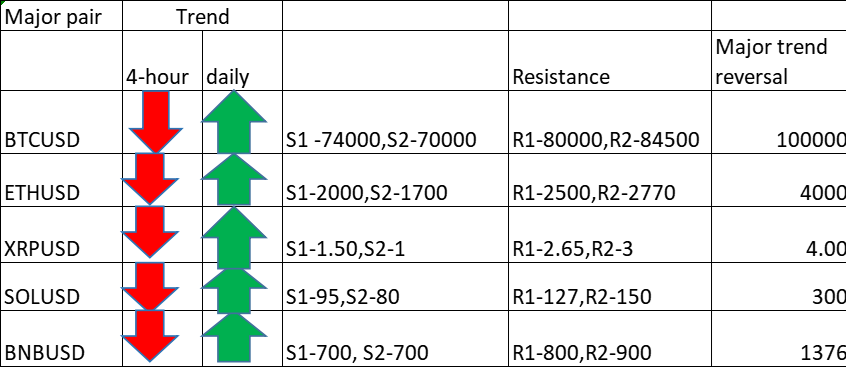

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data