Philippine central bank keeps interest rate on hold, likely to stand pat for sometime

Feb 07, 2019 12:23 pm UTC| Commentary Central Banks

The Philippine central bank kept its overnight RRP rate on hold at 4.75 percent during its monetary policy meeting today, as was anticipated. Accordingly, the BSP also left the overall interest rate corridor...

FxWirePro: Mounting GBP OTC Operations Ahead of BoE, Brexit and Other Apprehensions

Feb 07, 2019 10:45 am UTC| Research & Analysis Central Banks

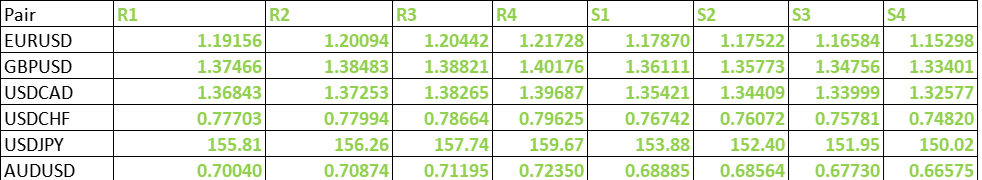

Sterling remains close to the bottom end of recent trading ranges as markets wait for todays update from the BoE and the outcome of PM Mays talks in Brussels. Meanwhile, the US dollar moved higher against the euro...

FxWirePro: BoE banks on Brexit deadlock, can it be most likely status quo monetary policy?

Feb 07, 2019 10:37 am UTC| Research & Analysis Central Banks Insights & Views

The Bank of England will provide its first policy decision and Inflation Report for the year in a short while. That will be followed by BoE Governor Carneys first press conference of 2019. The markets expectations for...

Feb 07, 2019 09:19 am UTC| Commentary Central Banks Economy

The Reserve Bank of New Zealand (RBNZ) is expected to adopt a wait-and-watch stance at the upcoming monetary policy meeting next week, while deciding to leave the benchmark interest rates on hold at 1.75 percent, according...

Bank of Thailand keeps interest rate unchanged at 1.75 pct, likely to hike by 25 bps in 2019

Feb 06, 2019 11:09 am UTC| Commentary Central Banks

The Thai central bank met today for its monetary policy decision. As was widely anticipated, the Bank of Thailand kept its policy rate on hold at 1.75 percent. However, the decision was not unanimous. Four members of the...

Feb 06, 2019 09:25 am UTC| Central Banks

The RBNZ is expected to remain on hold through this year at least, and that seems to quite agreeable. As a result, that should cap 2yr NZ yields at 2.30%, while a slight loss of economic momentum, both in NZ and in...

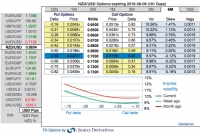

Bullish/Bearish Scenarios of NZD/USD, OTC Indications and Options Trading Perspective

Feb 06, 2019 08:05 am UTC| Research & Analysis Central Banks

Bearish NZDUSD scenarios below 0.60 if: 1) The NZ housing market slowdown becomes disorderly; 2)The NZ immigration rolls over more quickly; 3) Weaker business confidence sees firms dramatically cut...

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data