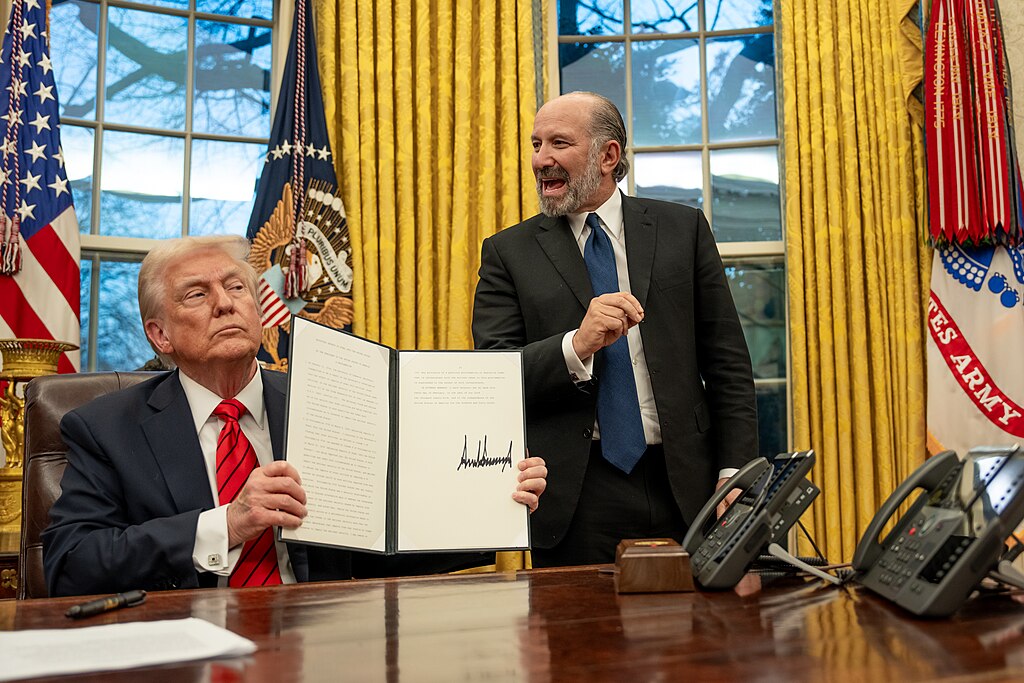

U.S. President Donald Trump aims to eliminate taxes for individuals earning less than $150,000 annually, according to Commerce Secretary Howard Lutnick in a recent CBS News interview.

“I know what his goal is—no tax for anybody making under $150,000 a year. That’s what I’m working for,” Lutnick stated, emphasizing Trump’s broader tax reform efforts. He also highlighted plans to remove taxes on tips, overtime, and Social Security, aligning with Trump’s push for substantial tax cuts for both individuals and corporations.

Concerns over rising national debt due to tax cuts were met with Lutnick’s assurance that increased revenue would come from tackling overseas tax fraud. He claimed that curbing tax evasion could help fund Trump’s ambitious tax policies without burdening American taxpayers. Additionally, he pointed to Trump’s proposed $5 million U.S. visa program as a way to boost fiscal revenue.

Trump’s $4.5 trillion tax cut plan was approved by the Republican-led House of Representatives in February and now faces a Senate vote. While his administration seeks to slash government spending to reduce the deficit, policies enforced by the Department of Government Efficiency—particularly mass layoffs of federal employees—have sparked controversy.

Economic concerns under Trump’s leadership have intensified, especially amid fears of a recession fueled by his aggressive tariff policies. When asked about potential economic risks, Lutnick stated that pushing Trump’s policies would be “worth it,” even if it meant facing a recession.

As debates continue, Trump’s tax strategy remains a central topic, shaping discussions on government revenue, job markets, and economic stability ahead of the upcoming elections.

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  United States Officially Exits World Health Organization, Raising Global Public Health Concerns

United States Officially Exits World Health Organization, Raising Global Public Health Concerns  Trump Administration Expands Global Gag Rule, Restricting U.S. Foreign Aid to Diversity and Gender Programs

Trump Administration Expands Global Gag Rule, Restricting U.S. Foreign Aid to Diversity and Gender Programs  Trump Threatens Aircraft Tariffs as U.S.-Canada Jet Certification Dispute Escalates

Trump Threatens Aircraft Tariffs as U.S.-Canada Jet Certification Dispute Escalates  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure

Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure  Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding

Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding  Trump Administration Gun Comments Spark Rift With NRA Ahead of Midterms

Trump Administration Gun Comments Spark Rift With NRA Ahead of Midterms  Sam Altman Criticizes ICE Enforcement as Corporate Leaders Call for De-Escalation

Sam Altman Criticizes ICE Enforcement as Corporate Leaders Call for De-Escalation  Minnesota Judge Rejects Bid to Halt Trump Immigration Enforcement in Minneapolis

Minnesota Judge Rejects Bid to Halt Trump Immigration Enforcement in Minneapolis  Kevin Warsh’s Fed Nomination Raises Questions Over Corporate Ties and U.S.–South Korea Trade Tensions

Kevin Warsh’s Fed Nomination Raises Questions Over Corporate Ties and U.S.–South Korea Trade Tensions  More Than 100 Venezuelan Political Prisoners Released Amid Ongoing Human Rights Scrutiny

More Than 100 Venezuelan Political Prisoners Released Amid Ongoing Human Rights Scrutiny  U.S. Imposes Visa Restrictions on Haiti Transitional Council Over Gang Allegations

U.S. Imposes Visa Restrictions on Haiti Transitional Council Over Gang Allegations  NTSB Opens Investigation Into Waymo Robotaxis After School Bus Safety Violations in Texas

NTSB Opens Investigation Into Waymo Robotaxis After School Bus Safety Violations in Texas  SEC Drops Gemini Enforcement Case After Full Repayment to Earn Investors

SEC Drops Gemini Enforcement Case After Full Repayment to Earn Investors  Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute

Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute