The EURCHF exchange rate has already eased back below the 1.14 mark and has therefore returned into areas that are likely to begin causing the Swiss National Bank (SNB) discomfort.

The central bank had seemed much more relaxed as regards the exchange rate when it climbed from levels around 1.10 to above 1.14 last year. Even though inflation in Switzerland is positive again, core inflation has remained at only 0.5% since the start of the year, which is anything but comfortable.

As a result, we would assume that the SNB will still not like to see strong franc appreciation. There is an acute risk of the SNB intervening the closer the EURCHF exchange rate gets to the 1.10 mark.

We maintain a decent exposure to CHF this week but rotate a slightly underwater position in USDCHF into an outright short in EURCHF due to ongoing noise in Turkey and what could be a greater focus by investors on the Italian budget into September.

GBPCHF has performed very well as investors for whatever reason have belatedly woken up to the non-negligible risk of a no-deal Brexit, and the sensitivity of GBP to this would suggest that investors have some reasonable GBP exposures that are under hedged.

As for CHF itself, we continue to highlight the ever- present positive balance of payments disequilibrium that can only be exacerbated by heightened EM stress, namely a current account that is too large for private sector investors to recycle given still relatively low average rate differentials between CHF and ROW.

The SNB has pretty much single-handedly recycled this surplus for an entire decade since the GFC hit, but with a balance sheet that has mushroomed to 125% of GDP as a result of this systematic FX intervention, legitimate questions marks exist over the SNB’s capacity and willingness to continue to take the other side of commercial flows, let alone absorb another round of deleveraging of whatever cross- border CHF funding positions may exist.

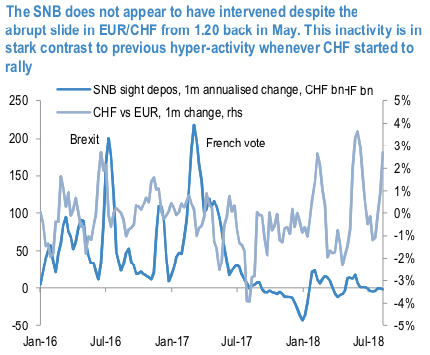

It is quite notable that the SNB appears not to have intervened since EURCHF rejected 1.20 back in early May (refer 6thchart).

Cover shorts in USDCHF at 0.9926.

Short in EURCHF at 1.1350, stop at 1.1550.

Stay short GBPCHF from 1.3051. Marked at 2.29%. Lower stop to 1.30.

Buy 6M GBPCHF - GBPUSD vol spread, equal-vega notional. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 110 (which is bullish), while hourly USD spot index was at -129 (bearish), while hourly CHF -70 (bearish) while articulating at 12:07 GMT. For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One