The Bank of Canada is the major market risk event over the coming week with a fairly light data release calendar on tap.

This will be a full set of Bank of Canada communications starting with the release of the statement and Monetary Policy Report with revised forecasts at 10amET on Wednesday.

Of-late CAD crosses have considerably gained in the recent rallies, with EURCAD dipped from 1.5640 to the current 1.5202 level, but spiked from the lows of 1.4754 to the current 1.5518 levels in the last couple of months. USDCAD slumped from 1.3664 to the current 1.3279 levels, and spiked from 1.2938 to the recent highs of 1.3664 levels.

Further material upside risks from the current levels will likely only come on a gradual basis given the BoC’s dovish rhetoric sees in upcoming monetary policy.

As the Canadian central bank Governor Poloz and Senior Deputy Governor Wilkins will host a press conference at 11:15amET, key will be the general bias provided through forecast guidance.

Although 25 bps is expected, the status quo in overall policy outlook is expected. It’s likely that the BoC will retain its stance as to how the further policy interest rate will need to rise into a neutral range to achieve the inflation target, while at the same time signalling near-term patience in getting there by emphasizing data dependence. GDP growth is likely tracking around 2% in Q4 and hence a little weaker than the BoC’s forecast for 2.3% in the October MPR and after Q3 growth of 2% exceeded the BoC’s forecast for 1.8%, leaving the overall Q3–Q4 picture tracking broadly in line with the BoC’s expectations.

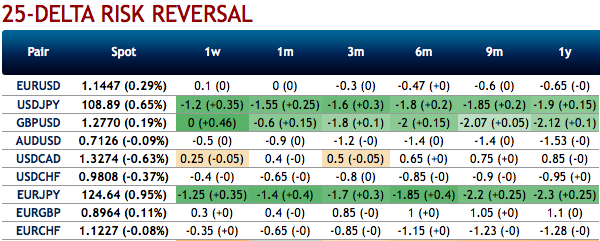

Let’s just quickly glance at OTC updates of CAD crosses.

One can observe positive shift in risk reversal numbers for USDCAD that indicate momentary bids for USDCAD’s downside risks in the shorter tenors, while the downside risk sentiments remain intact.

While the implied volatility skews (IVs) bid for OTM calls upto 1.35, IVs have continued to signify hedgers’ interest in the upside risks. While same has been the case with EURCAD.

IV skews as the implied volatility as a function of moneyness for a fixed time to maturity that is usually referred to as the smile.

Thus, both the speculators and hedgers who are keen on bearish risks in the minor trend are advised to capitalize on current downswings and bid theta call shorts in the short tenors, on the flip side, 2m skews to optimally utilize delta longs.

Thereby, one can devise hedging strategies capitalizing on prevailing dips, shorting2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options. Courtesy: Sentrix, scotia and saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 61 (which is bullish), while hourly USD spot index was at -118 (bearish) at 12:41 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays