In this write up we emphasize on the opportunity in shorting cable volatility without harming FX portfolio. Well, we’ve seen a very turbulent 2016, hereafter, no much dramatic action expected in the GBP space, but the frequency of impulsive events increased spectacularly.

There is a compelling case to short GBPUSD volatility, but implementing this view as a naked short is much too risky. So we suggest two ways to circumvent the issue: a directional trade with a risk limited to the premium, and a relative value volatility trade involving GBP in its two legs.

Directional trade: a cable DNT

The view of a cable range and capped volatility directly suggests a Double No Touch (DNT) implementation. The risk is limited to the premium and the volatility profile is very interesting for the specific GBP risk.

This option is short vega so that it benefits from lower implied volatility. It is also long volga, which means positive exposure to the volatility of volatility, and therefore to tail risk.

With a market horizon as long as six months and a decent volatility risk premium, the market implied probability of hitting the bounds of such a payoff will be sufficiently high to produce attractive leverage.

Cable in the middle of the 1.20-1.30 range is an attractive entry point. In current market conditions, setting the DNT bound at 1.19 and 1.30 produces leverage above 7 times.

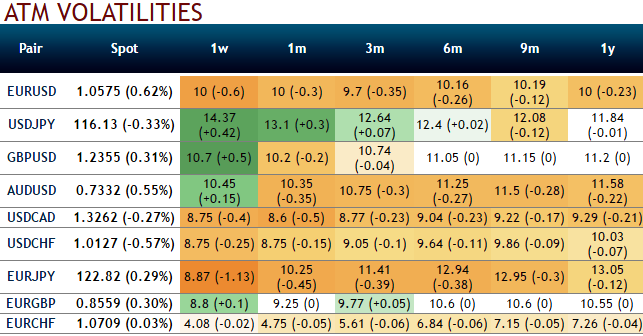

After a surge due to GBP intrinsic risk, the EURGBP is going to be increasingly euro driven. EURGBP volatility is likely to rise as the EURUSD heads to parity and then bounce as the ECB tapers purchases. At the same time, cable volatility should remain constrained, suggesting buying EURGBP volatility against GBPUSD.

Interestingly, the market is already pricing this volatility up to the 6m tenor, as the spread very recently turned negative, but the 1y spread is slower to adjust and will have to follow. Such a spread mitigates GBP risk, which is compensated in the two legs.

Since February 2016, the 1y spread has traded between flat and one volatility point, and the Brexit headlines in June and October did not really shake it, conferring an attractive relative value feature.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?