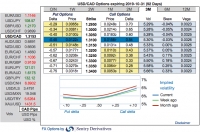

FxWirePro: USD/CAD ‘diagonal call spreads’ for both hedging and trading objectives ahead of Fed

Jul 31, 2019 11:13 am UTC| Research & Analysis Central Banks

Over the last two months, domestic Canadian data has outperformed and, together with intensified Fed cut expectations, has driven USDCAD to the years lows. CAD appreciation in G10 against the dollar, having largely shaken...

Regulatory Series on Cryptocurrencies: US SEC’s meticulous approach on cryptocurrencies continues

Jul 31, 2019 05:41 am UTC| Research & Analysis Digital Currency Insights & Views

We have seen cryptocurrency struggle ever since the U.S. SEC (Securities and Exchange Commission) declined the Winklevoss twins attempts of launching a bitcoin ETFs. The US regulatory agency (SEC), has constantly shown...

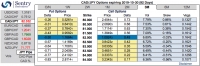

FxWirePro: Bid 3m CAD/JPY IV Skews and Deploy Options Strips on Status-quo BoJ

Jul 30, 2019 11:45 am UTC| Research & Analysis Central Banks

We should give a mention to the Bank of Japans (BoJ) rate meeting. Even though the central bank council did not decide on any new measures it cannot ignore the global tendency towards more expansionary monetary policy,...

Regulatory Series on Cryptocurrencies: Chief of SEC Enforcement for Cryptocurrency Steps Down

Jul 30, 2019 05:39 am UTC| Research & Analysis Digital Currency Insights & Views

We have seen cryptocurrency struggle ever since the U.S. SEC (Securities and Exchange Commission) declined the various firms attempts to launch a bitcoin ETFs. While the chief of Securities and Exchange Commissions...

FxWirePro: Take a look at CBR’s rate cuts and USD/RUB options trades

Jul 29, 2019 13:20 pm UTC| Research & Analysis Central Banks

As expected, the Russian central bank (CBR) lowered its key rate by 25bp to 7.25% on Friday. It has already lowered its inflation outlook considerably in June: for the end of 2019, it expects an inflation rate of 4.2-4.7%,...

FxWirePro: A Run Through on Scandinavian FX Valuations and Trade Recommendations

Jul 29, 2019 13:07 pm UTC| Research & Analysis Central Banks

NOKs lagging performance despite a wider rate differential is explained by crude prices. Assuming usual betas relative to oil, one could argue that EURNOK should have remained range-bound, yet the cross has drifted lower...

FxWirePro: The Key Factors in U.S.-Japan Trade Negotiations That Drive JPY – Uphold Short Hedges

Jul 29, 2019 11:45 am UTC| Research & Analysis

Full-scale U.S.-Japan trade negotiations could affect JPY fairly substantially. We point out five key factors below, the first three of which could lead to JPY appreciation in the short term and the last two of which could...

- Market Data