Currency snapshot (commodity pairs)

Oct 28, 2015 16:48 pm UTC| Insights & Views

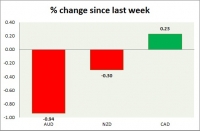

Dollar index trading at 96.59 (-0.32%) Strength meter (today so far) - Aussie -0.70%, Kiwi -0.78%, Loonie +1.05%. Strength meter (since last week) - Aussie -0.94%, Kiwi -0.30%, Loonie +0.23%. AUD/USD - Trading at...

Currency snapshot (major pairs)

Oct 28, 2015 16:39 pm UTC| Insights & Views

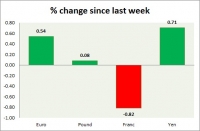

Dollar index trading at 96.55 (-0.37%). Strength meter (today so far) - Euro +0.35%, Franc +0.23%, Yen -0.04%, GBP +0.06% Strength meter (since last week) - Euro +0.54%, Franc -0.82%, Yen +0.71%, GBP +0.08% EUR/USD...

Oct 28, 2015 16:28 pm UTC| Insights & Views

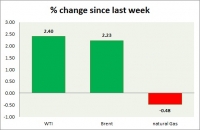

Energy pack is trading green todays trading. Weekly performance at a glance in chart table. Oil (WTI) - WTI is sharply up today, ahead of FOMC on short covering. Todays range $43-46 Bears are likely to push towards...

Iron ore slump shows Chinese economic woes not over

Oct 28, 2015 15:01 pm UTC| Insights & Views

Persistent weakness in global commodity prices suggest that recent optimism on China may be short lived. Over the past few days global energy prices have fallen, accompanied by some industrial metals. Iron ore prices...

FxWirePro: Loonie edgy ahead of crude inventory and FOMC - Long iron butterfly for cynic bulls

Oct 28, 2015 13:42 pm UTC| Insights & Views

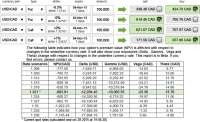

Last week EIA reported crude oil inventory at 8.0M which was a rise from previous 7.6M, as a result crude prices began dropping which in turn led to CAD losses. This depreciation in CAD in H2 2014 has underpinned majorly...

Oct 28, 2015 13:12 pm UTC| Insights & Views Central Banks

Today Reserve Bank of New Zealand (RBNZ) will announce after meeting monetary policy decisions at 20:00 GMT. Economic condition New Zealands economy overall remained robust throughout past years however started...

Massive volatility in Natural gas, is this reversal

Oct 28, 2015 12:20 pm UTC| Insights & Views

For the past few days natural gas is showing unprecedented volatility, which has baffled many in the market. Daily candlestick chart shows, massive buying today, followed by a big hammer yesterday. So is this the reversal...

- Market Data