CBR likely to cut key rate by 25 bps to 8.75 pct as trend inflation slows further, says Danske Bank

Jul 25, 2017 06:42 am UTC| Commentary Central Banks Economy

This Friday at 12:30 CET, the Central Bank of Russia (CBR) is due to announce its monetary policy decision. On the back of Bloombergs most recent poll, it is expected that the CBR will cut the key rate by 25 basis points...

US Federal Reserve likely to leave policy rates unchanged at July policy meeting, says Lloyds Bank

Jul 24, 2017 11:25 am UTC| Commentary Central Banks Economy

The United States Federal Reserve is expected to leave its policy interest rates unchanged at its July 25-26 policy meeting. As the Fed raised interest rates by 0.25 percent for the third time in about seven months at its...

Jul 24, 2017 11:06 am UTC| Insights & Views Economy Central Banks

IHS Markits euro zone Flash Composite Purchasing Managers Index for July fell to 55.8 from 56.3 in the previous month. The reading was below median expectation in a Reuters poll for a modest dip to 56.2. Despite coming off...

Fundamentals to watch out for this week

Jul 24, 2017 10:25 am UTC| Commentary Central Banks

This week is quite risk-heavy, both in terms of data and events. What to watch for over the coming days: Central Banks: Bank of Englands (BoE) chief economist Andy Haldane is scheduled to speak on Tuesday....

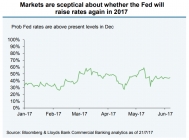

Fed Hike aftermath Series: Hike odds decline further ahead of FOMC meeting this week

Jul 24, 2017 06:08 am UTC| Commentary Central Banks

FOMC policymakers are set to meet this week and announce their monetary policy decision on Wednesday. Not much is expected from this meeting, where no press conference would be held. According to Fed projections in June,...

SARB may cut rates again if inflation outlook does not deteriorate, says Commerzbank

Jul 21, 2017 23:01 pm UTC| Commentary Central Banks

The South Africa Reserve Bank surprisingly lowered its key interest rate on Thursday to 6.75 percent from 7 percent. However, the decision was not unanimous as only four out of six council members voted for the cut....

US Federal Reserve likely to leave policy rates unchanged at July policy meeting

Jul 21, 2017 11:33 am UTC| Insights & Views Central Banks

The US Federal Reserve raised interest rates by 0.25 percent for the third time in about seven months at its last meeting in June. Investors look ahead to next weeks FOMC monetary policy announcement at the 25th-26th July...

- Market Data