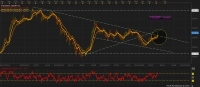

Fundamental Evaluation Series: USD/SEK vs. 2-year yield spread

Jul 17, 2018 11:30 am UTC| Commentary Central Banks

The chart above shows, how the relationship between USD/SEK and 2-year yield spread has unfolded since 2012. Brief background: The Sveriges Riksbank (SRB) began reducing interest rates (repo rates) in the...

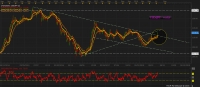

Fundamental Evaluation Series: USD/DKK vs. 2-year yield spread

Jul 17, 2018 11:27 am UTC| Commentary Central Banks

The chart above shows, how the relationship between USD/DKK and 2-year yield spread has unfolded since 2012. Brief Background: It can be seen that the pair and the yield spread between 2-year treasury and...

Fundamental Evaluation Series: USD/DKK vs. 2-year yield spread

Jul 17, 2018 11:27 am UTC| Commentary Central Banks

The chart above shows, how the relationship between USD/DKK and 2-year yield spread has unfolded since 2012. Brief Background: It can be seen that the pair and the yield spread between 2-year treasury and...

FxWirePro Call Review: As feared weaker yen threatens our bearish outlook in Nikkei225

Jul 17, 2018 07:28 am UTC| Commentary Central Banks

In February this year, we called on our readers to go short on Nikkei225 as we finally expected the tide to change direction amid loose monetary policy windup,...

FxWirePro: Possibility of further 10 percent decline in Japanese yen rises

Jul 17, 2018 05:33 am UTC| Commentary Central Banks

After strengthening to as high as 104.6 per dollar in March this year and showing some signs that it might strengthen further riding on risk aversion stemming from trade war between the United States and China, the yen has...

FxWirePro: Possibility of further 10 percent decline in Japanese yen rises

Jul 17, 2018 05:33 am UTC| Commentary Central Banks

After strengthening to as high as 104.6 per dollar in March this year and showing some signs that it might strengthen further riding on risk aversion stemming from trade war between the United States and China, the yen has...

FxWirePro: The Day Ahead- 17th July 2018

Jul 17, 2018 04:22 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and all with low to medium volatility risks associated. Data released so far: China: House price growth up 5 percent y/y in June. Upcoming: Italy:...

- Market Data