Japanese Yen outperforms in risk-off mood; while BoJ doesn’t cut, doubles asset purchases. The temptation is to be long the USDJPY for now. But with implied vols still elevated and risk reversals heavily favouring USD puts, we continue to look for USDJPY downside.

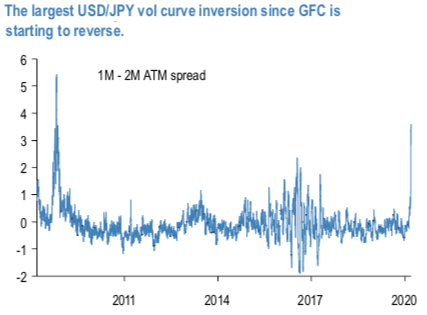

Earlier this week yen vol curve has inverted the most since GFC and retraced 70% of the 2008 peak (refer 1stchart) while widening of the risk reversals (in relative terms to ATM vols) has even exceeded the GFC levels. That dislocation has started to reverse.

Our yen analysts see USDJPY above 100. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure. The - 1M/+2M and -2M/+4M call calendars are the sweet spot showing the most attractive trade-off between pay-out and static carry characteristics.

Conducting terminal payoff analysis across various spot and vol scenarios in 2nd chart, we track net P/L at expiry of front tenor leg (i.e. aged calendar) across the space of +/-6% spot and +/-4 vol outcomes. The payoff grid shows the -2M/+4M USDJPY 30D calendar to have well defined downside and positive P/L in most scenarios.

Consider: Short 2M vs long 4M USDJPY 110 (30 delta) strike vanilla call calendar (non-delta hedged) costs 45bps USD, 70% discount to 4M outright, spot ref 107.40. Courtesy: JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data