FxWirePro- GBPJPY Daily Outlook

Feb 03, 2022 07:42 am UTC| Technicals

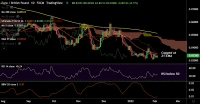

Short-term resistance -155.35 Intraday Support- 154 GBPJPY is trading flat ahead of Bank of England monetary policy. The central bank expected to lift rates by 25bpbs to combat higher inflation. The pound...

FxWirePro: AUD/NZD hits fresh 8-month high, on track to test channel top at 1.0830

Feb 03, 2022 06:02 am UTC| Technicals

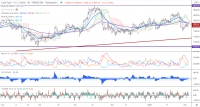

Chart - Courtesy Trading View Technical Analysis: Bias Bullish - AUD/NZD was trading 0.04% higher on the day at 1.0757 at around 05:50 GMT - The pair is extending 200-week MA breakout, scope for further gains -...

FxWirePro: EUR/GBP hovers around 5-DMA, traders await BoE, ECB policy meetings

Feb 03, 2022 05:46 am UTC| Technicals

Chart - Courtesy Trading View Spot Analysis: EUR/GBP was trading 0.15% higher on the day at 0.8336 at around 05:30 GMT Previous Weeks High/ Low: 0.8422/ 0.8305 Previous Sessions High/ Low: 0.8351/...

Feb 03, 2022 05:01 am UTC| Technicals

Ichimoku Analysis (4-Hour chart) Tenken-Sen- $1802.68 Kijun-Sen- $1795.60 Gold regained above $1800 as the US dollar tumbles after weak US ADP employment data. The number of private jobs dropped -301k...

FxWirePro:GBP/NZD maintains bullish bias with focus on 2.0550

Feb 03, 2022 01:28 am UTC| Technicals

GBP/ NZD strengthened on Wednesday as sterling was boosted by increased expectation Bank of England will raise interest rate . Markets will focus on BoE pressers on Thursday, for hints at near-term rate paths,...

FxWirePro: GBP/AUD steadies above 1.9000, good to buy on dips

Feb 03, 2022 01:18 am UTC| Technicals

GBP /AUD strengthened on Wednesday as BoE rate hike expectations boosted pound. Investors have now fully priced a 25-basis-point rise in the BoEs main interest rate to 0.50% on Feb. 3rd The pair is currently...

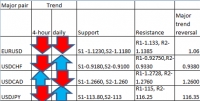

FxWirePro-Major pair levels and bias summary

Feb 02, 2022 16:44 pm UTC| Technicals

Major pair levels and bias...

- Market Data