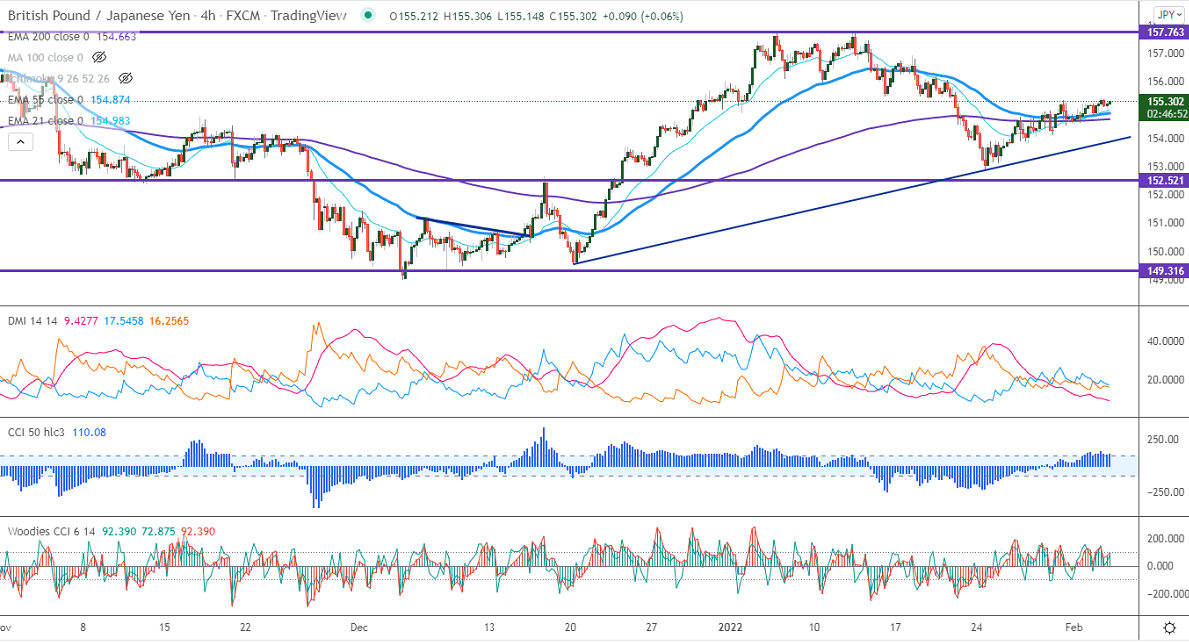

Short-term resistance -155.35

Intraday Support- 154

GBPJPY is trading flat ahead of Bank of England monetary policy. The central bank expected to lift rates by 25bpbs to combat higher inflation. The pound sterling is holding above 1.35000. Any breach above 1.3600 will take the pair to the next level 1.3700. The intraday trend of GBPJPY is bullish as long as support 154 holds. GBPJPY hits an intraday high of 155.29 and is currently trading around 155.23.

USDJPY- Analysis

The pair is consolidating after five days of weakness. Market sentiment remains silent ahead of the central bank meeting. The intraday bullishness if it breaks 115.70.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero levels in the 4 -hour chart. It confirms the bullish trend.

Technical:

The immediate resistance is around 155.35, any break above targets 155.70/156.10/157. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 154.60. Any indicative violation below targets 154/153/151.95/150.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to buy on dips around 154.65-70 with SL around 154 for a TP of 157.