French IP in March likely to hit Euro, use PRS for hedging

May 04, 2015 11:53 am UTC| Insights & Views

We predict the French National Institute of Statistics to report that industrial activity increased by 0.2% MoM in March (1.3% yoy). If this prediction materialized then this would lead the industrial output to rise on QoQ...

Fears over UK election surpass Scottish referendum

May 04, 2015 11:52 am UTC| Insights & Views

Pound traders are becoming wary of UK election outcome, as measured through implied volatility in the option market. One week pound/dollar implied volatility which is a measure of anxiety over pounds movement has...

Yemen fight pushes Brent higher

May 04, 2015 11:27 am UTC| Insights & Views

Fight has intensified in Yemen over the weekend as Saudi supported rebel groups trying to take over an important airport from Iran backed Houthi fighters near Aden Port. Saudi Arabia is reported to be preparing for...

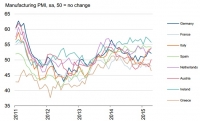

Euro zone continues to grow, while France and Greece falters

May 04, 2015 10:32 am UTC| Insights & Views

According to data published by markiteconomics Euro zone continued its growth in manufacturing sector as of April, however the pace was dragged down by further slowdown in Greece and France. Overall growth in Eurozone...

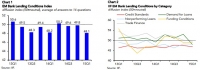

Emerging market vulnerability – Bank lending

May 04, 2015 10:25 am UTC| Insights & Views

According to survey by Institute for International Finance (IIF), composite index for EM bank lending conditions dropped to 48.1 in first quarter of 2015, lowest level since fourth quarter of 2011. Major drop in overall...

Hedge risky MYR with swaps against uncertainty in global economies

May 04, 2015 09:30 am UTC| Insights & Views

As BNM (Bank Negara Malaysia) will pronounce its next monetary policy decision on 7th May. We look ahead for overnight policy rate (OPR) to remain unchanged at 3.25%. The central bank detached the word "appropriate" from...

Italy’s growth comeback is good news for FTSE MIB

May 04, 2015 08:33 am UTC| Insights & Views

Signs are now abundant that growth in Italy is coming back to life along with Eurozone. Euro zones third largest economys rebound is very vital as it holds second highest Debt/GDP ratio close to 130% after Greece. This was...

- Market Data