May 04, 2015 15:09 pm UTC| Insights & Views

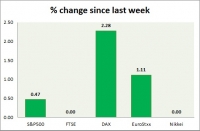

Equities are all trading in green today, after massive selloff of last week. Performance this week at a glance in chart table - SP 500 - SP might be moving to test all time high around 2125, currently trading at 2118...

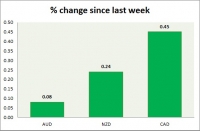

Currency snapshot (commodity pairs)

May 04, 2015 14:40 pm UTC| Insights & Views

Dollar index trading at 95.39 (+0.18%). Strength meter (today so far) - Aussie +0.08%, Kiwi +0.24%, Loonie +0.45%. Strength meter (since last week) - Aussie +0.08%, Kiwi +0.24%, Loonie +0.45%. AUD/USD - Trading at...

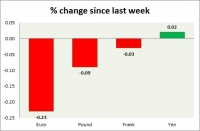

Currency snapshot (major pairs)

May 04, 2015 14:15 pm UTC| Insights & Views

Dollar index trading at 95.33 (+0.12%). Strength meter (today so far) - Euro -0.23%, Franc -0.09%, Yen +0.02%, GBP -0.03% Strength meter (since last week) - Euro -0.23%, Franc -0.09%, Yen +0.02%, GBP -0.03% EUR/USD...

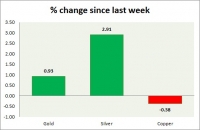

Commodities snapshot (precious & industrial)

May 04, 2015 13:48 pm UTC| Insights & Views

Precious pack remains worst performer, in spite of weaker dollar. Performance this week at a glance in chart table - Gold - Gold bears were being halted at $1178 support and whereas bulls are struggling above $1200...

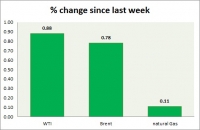

May 04, 2015 13:11 pm UTC| Insights & Views

Energy segment is mixed in todays trading with oil gaining and gas losing ground. Weekly performance at a glance in chart table. Oil (WTI) - WTI is struggling to break $60 as crude stocks continue to pile up. Partial...

Sterling to make minor gains on UK Polls, construction PMI; trade with short butterfly

May 04, 2015 13:09 pm UTC| Insights & Views

The construction data are currently somewhat of an enigma. The housing market should be benefiting from super low mortgage rates and the high level of consumer confidence but, in fact, housing construction is actually...

Break even inflation creeps up amid weaker dollar

May 04, 2015 12:34 pm UTC| Insights & Views

Dollar has taken a major hit last week as speculation over Federal Reserve rate hike faded from June to December. However US benchmark yield are on the rise, in spite of falling dollar. As a matter of fact, falling...

- Market Data